Real estate has been a strong contributor to wealth creation across nearly all property types over the last few decades. In the San Francisco Bay Area especially, the combination of capital appreciation and rising rental rates has made real estate particularly attractive. When you add the tax advantages of depreciation, the preferential treatment of capital gains (through tools like 1031 exchanges), and the ability to grow wealth through leverage, it’s no surprise that many investors have built meaningful portfolios that generate steady cash flow.

Although today’s higher interest rates and compressed cap rates have made real estate acquisition less appealing than in years past, for those who already own well-positioned properties, real estate continues to play a critical role in both income generation and long-term wealth planning.

As financial advisors and asset allocators, our job is to consider the full financial picture—not just the investment accounts under our management. That includes analyzing real estate cash flow, liquidity needs, tax efficiency, and long-term goals. This comprehensive view allows us to tailor portfolio recommendations to each client’s unique circumstances.

Let’s explore how this plays out by comparing two hypothetical retirees with similar net worths but very different asset compositions.

Retiree #1: Traditional Investor

- $7 million in a diversified investment portfolio (stocks and bonds)

- $250,000 annual spending need from the investment portfolio

- Recommended allocation: 65% stocks / 35% bonds

This retiree depends fully on their investment portfolio to fund retirement. A traditional balanced allocation helps manage risk while generating income. With $2.45 million in bonds (35% of $7M), they have nearly 10 years of spending needs covered by more stable assets—providing a reliable buffer in the event of market volatility. This is a common and appropriate approach for clients drawing consistent income from their investments.

Retiree #2: Real Estate-Heavy Investor

- $5 million in income-producing real estate

- $2 million investment portfolio

- Annual spending needs fully covered by real estate cash flow

- Recommended allocation: 80% stocks / 20% bonds—or more aggressive based on tolerance and goals.

This client’s financial situation is quite different. Their real estate portfolio generates sufficient rental income to cover all ongoing expenses. As a result, their $2 million investment portfolio isn’t needed for immediate income—it’s a growth asset, not a spending reserve.

This significantly changes the role of the investment portfolio. Since there’s no need to draw from it regularly, the portfolio doesn’t need the same level of bond allocation for income stability. Instead, we can pursue a more aggressive strategy focused on long-term growth, such as an 80/20 or even more aggressive, depending on the client’s risk tolerance and goals.

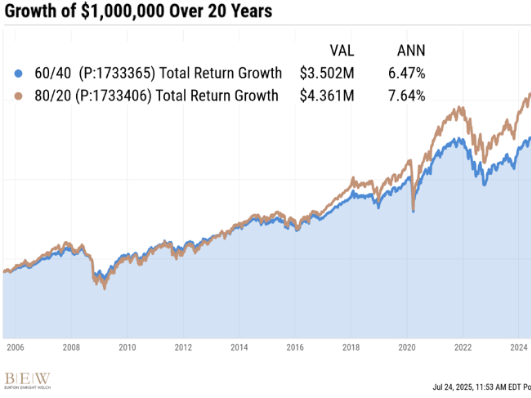

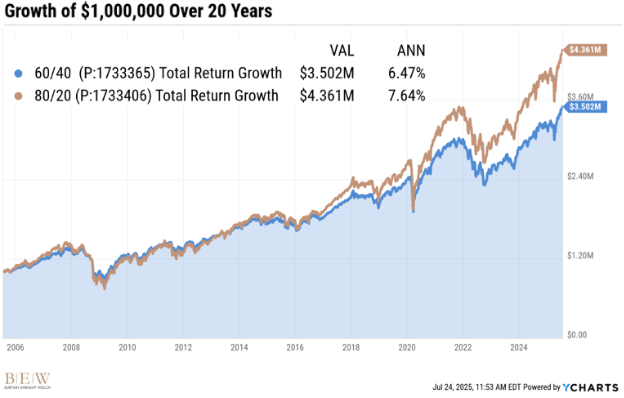

Historical Return Comparison of 60/40 vs 80/20 portfolio

When we look at long-term data, a modest shift toward more equities can meaningfully impact wealth accumulation over time. Over the last 20 years, a globally diversified 60/40 portfolio (60% stocks / 40% bonds) has generated annualized returns of around 6.5%, while a more growth-oriented 80/20 portfolio has averaged closer to 7.6%.

On the surface, the difference of roughly 1.1% per year may not seem significant. But due to the power of compounding, even a small return differential can lead to a dramatically larger portfolio value over 20 years ($3.5M vs $4.4M).

For traditional retirees who rely on their portfolio for income, the extra volatility of an 80/20 mix can feel too risky because they may need to sell during market downturns. However, for a real estate-heavy investor who doesn’t need to draw from the portfolio regularly, this additional growth potential can be captured without jeopardizing their income security.

Why Private Real Estate Can Act Like Bonds

Real estate, especially when diversified across multiple properties, asset classes, geographies, or tenants (especially investment grade), shares several key characteristics with fixed income:

- Consistent, recurring cash flow

- Low correlation to stock market volatility

- Inflation sensitivity (rents often rise with inflation)

- Tax efficiency, thanks to depreciation and capital gains treatment

In effect, real estate can fulfill the stability and income role that bonds traditionally play, especially for investors who already own mature, cash-flowing properties.

This allows us to repurpose the investment portfolio for longer-term growth, rather than liquidity. It also creates planning opportunities like Roth conversions, tax-efficient gifting, or opportunistic investing without the need to draw down the principal.

Final Thoughts

Real estate investors aren’t just landlords—they’re often running a parallel retirement income engine that advisors need to account for. A well-diversified real estate portfolio can shift the balance of how much risk a client needs to take in their investment accounts and how much liquidity they truly need.

By understanding the full picture and tailoring the asset allocation accordingly, we can help real estate-heavy investors optimize their portfolios—not just diversify them. Each client is unique, just like their real estate portfolios. We have the expertise to understand real estate investors’ needs, global cash flows, and offer solutions for each client based on their situation.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.