Yesterday, we hosted Dr. Apollo Lupescu, Vice President at Dimensional Fund Advisors, for a wide-ranging 55-minute conversation on markets, rates, debt, and the dollar.

Apollo is known for making complex topics simple, and he tackled some tricky subjects.

Click the link below to watch the replay.

Summary highlights follow.

A Surprisingly Strong Year for Investors

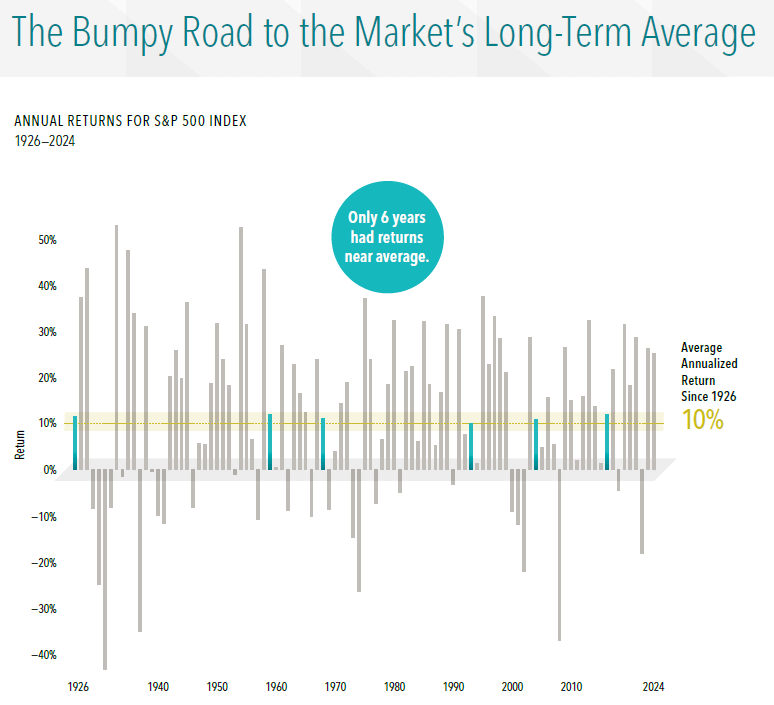

- Despite a bumpy first half and constant scary headlines, diversified portfolios are upsolidly year-to-date.

- International stocks have outpaced U.S. markets in 2025.

- Discipline through volatility once again paid off.

The “Magnificent Seven” and Diversification

- Seven large U.S. tech names drove much of the index gains.

- A globally diversified portfolio includes them but avoids over-concentration.

What the Fed Actually Controls

- Fed actions mainly affect short-term rates (overnight to one-month).

- Mortgage and 10-year Treasury yields move with inflation expectations and global demand for bonds.

- Lower Fed rates don’t automatically translate into lower mortgage costs.

Debt and Deficits in Perspective

- The key metric isn’t the size of U.S. debt but interest cost as a share of GDP.

- That ratio remains manageable, though higher rates make it worth watching.

- Markets continually “vote” on U.S. creditworthiness—and still price Treasuries as the world’s safe asset.

Dollar Dominance

- Roughly 60% of global reserves remain in U.S. dollars; no other currency comes close.

- A weaker dollar can boost returns on international investments.

- No credible alternative system or bond market rivals U.S. depth and liquidity.

Gold’s Role Today

- Gold is volatile and is an unreliable inflation hedge.

- Investors already have modest gold exposure through global equity holdings.

- For true inflation protection, Treasury Inflation-Protected Securities (TIPS) do the job better.

Staying Grounded Amid the Noise

- A sound financial plan anticipates market swings.

- The two emotions to watch: fear of loss and fear of missing out.

- Talk to your advisor before reacting to headlines—perspective beats prediction.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.