2017 Year-End Summary

The following is excerpted from our client newsletter...

A year ago, we asked you to imagine it was January 1, 2016 and your crystal ball revealed 2016’s headlines. How would your expectations have compared to 2016’s reality: healthy gains and low volatility?

The same exercise works even better for 2017. Another year of dramatic headlines begat bigger gains and record low volatility. These two years should quiet notions that political volatility leads to stock market volatility.

As advisers, we enjoy a fascinating vantage point. We follow the markets daily and communicate daily with clients who follow the markets intermittently.

It is hard to imagine a more enjoyable year for investors. Yet, relative to past bull markets we’ve seen, there is a striking uneasiness. Many remain skeptical, citing a run-up in stock values, politics, another Great Recession, etc.

The upside is that skepticism constrains euphoria, which fuels risky behavior and at times market bubbles. The downside is that skepticism can cause people to opt out of investing.

Case in point, today banks pay savers a near record low in interest, yet there is a record $15.5 trillion in cash accounts. In 2017, cash was nearly the only asset to lose value – savers lost about 2% in purchasing power to inflation.

Meanwhile, retirements lengthen. While overall U.S. life expectancy dropped, life expectancy for 65-year olds set a record. The math of inflation and longer retirement demands that most people accept investment risk.

Occasionally, years like 2017 happen. Global stocks posted big gains. The few downturns were remarkably mild. Even humdrum bonds overshot expectations. You had to be there to participate.

In sum, everyone should take a moment to appreciate 2017 and pat themselves on the back. As always, the world offered many causes for concern. You overcame skepticism, remained disciplined, and profited.

Calm Markets

The S&P 500 was positive for the ninth year in a row and the fourteenth year out of the last fifteen. The climb was unusually steady and incremental. For the first time ever, the S&P grew in all twelve months.

Market calm was not just a U.S. phenomenon. The global markets set a record with only two days of an over a 1% drop. Investors should appreciate how much of an outlier 2017 was (see below).

International Stocks

We have made the case for international stocks the past few years. Following a strong latter half of 2016, foreign stocks had an exceptional 2017. And despite the run, they remain a better value than U.S. stocks.

Two major trends contributed. First, after years of sluggish global growth, particularly in Europe, GDP growth rose sharply worldwide in 2017.

Second, the U.S. dollar lost value against foreign currencies. A weakening dollar boosts U.S. investors’ foreign stock returns – gains exchange into more dollars. In 2017, a third of international returns came from a weakening dollar.

Emerging Markets

Emerging market (EM) stocks in 2017 are the classic case of the market rewarding patience. EM investors have had to slog through years of underperformance, including a -14.6% return in 2015. Last year’s 37.3% return was the highest for EM stocks since 2009.

Since early 2016, EM stocks have outpaced developed market stocks. In the past, EM investors have enjoyed sustained periods of sizable outperformance.

Much of the future depends on China. China’s growth and reforms have been relatively smooth. Yet concerns remain about the government’s ability to transition the economy without a financial shock. In light of the risks, our EM managers have incorporated rules to prevent overweighting Chinese stocks.

Fixed Income

We include fixed income in our portfolios to dampen volatility and produce a modest return over inflation. That’s the long-term goal, though like stocks, year-to-year results can differ significantly, as in 2017.

Our fixed income managers had a stellar 2017; all of them bested their index – the Barclays US Agg - a few by a wide margin.

Our managers are also beating the Agg on a trialing five-year basis. Here, results are closer to expectations. The funds are providing a modest but noteworthy boost over inflation, which has averaged about 2% annually.

What Does 2017 Mean for 2018?

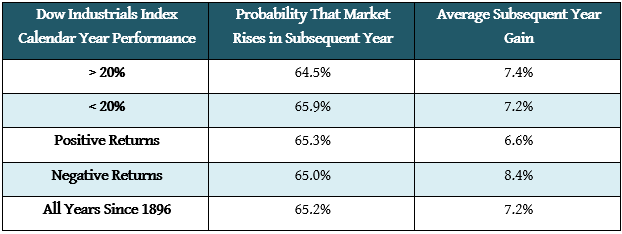

The below table shows the Dow index’s subsequent-year results broken down by the previous year’s performance. As you can see, a great prior year does not affect the likelihood of a good or bad following year.

Across asset classes, 2017 was an uncommonly profitable year for investors. Do not let 2017 impact expectations for 2018. Our sole prediction is that next year will be different in new and unforeseeable ways.