Does Anyone Remember August?

In July, the S&P 500 hit a milestone – the longest streak of days without a 2% decline since the Great Financial Crisis.

Even compared to 2021 and 2023, 2024 had been steady up to that point.

Then, the market fell 8.5% over two weeks.

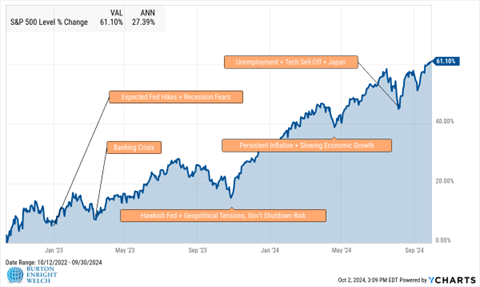

On cue, the media seized the story – a tech sell-off, rising unemployment rates, and carnage in the Japanese stock market.

Pundits speculated about more pain to come. With the election looming, many agreed that the rest of the year would be volatile.

But wait … does anyone remember this?!

The market reversed and delivered gains in August and September. The S&P 500 has tallied 43 all-time highs this year. Through September 30, the index was up 20.8%, the best start to the year since 1997 and the best start to a presidential election year in history.

We often refer to the Dot-Com Bubble, the Great Financial Crisis, and the Covid Crash. We don’t need to elaborate – each event is shorthand for stress, drama, and portfolio pain.

Yet, in-between these landmarks are mini slides that feel momentous and then fall into history’s dustbin. In March 2023, Silicon Valley Bank and First Republic seemed to foreshadow another financial crisis. But no more dominoes fell, and we all moved on.

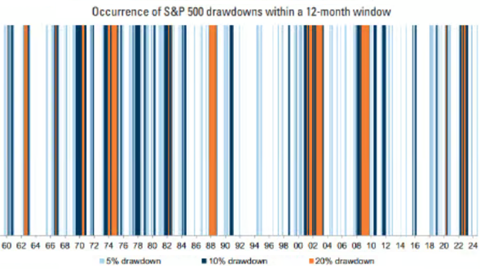

Since 1990, bear markets (-20%) and corrections (-10%) have occurred less frequently. Yet, 5+% declines are as common as ever.

To succeed, investors must separate short-term noise from long-term fundamentals. Those who withstood the five 5+% slides over the last two years were rewarded with a 60% gain.

The scars from 2000, 2008, and 2020 still shape how we perceive market dips. The sensational stories about August 2024’s slide – tech crash, recession, crisis abroad – press on investors’ old wounds. We are primed to foresee catastrophe and overreact.

We look to the news during dramatic events. Yet, we soon forget countless headlines that presage a crisis that never materializes.

We don’t look to the news during the slow, steady grind of markets upwards. And even if we did, the headlines wouldn’t blare – “Things Are a Bit Better Than Before.”

Yet, that is the predominant story for long-term investors.