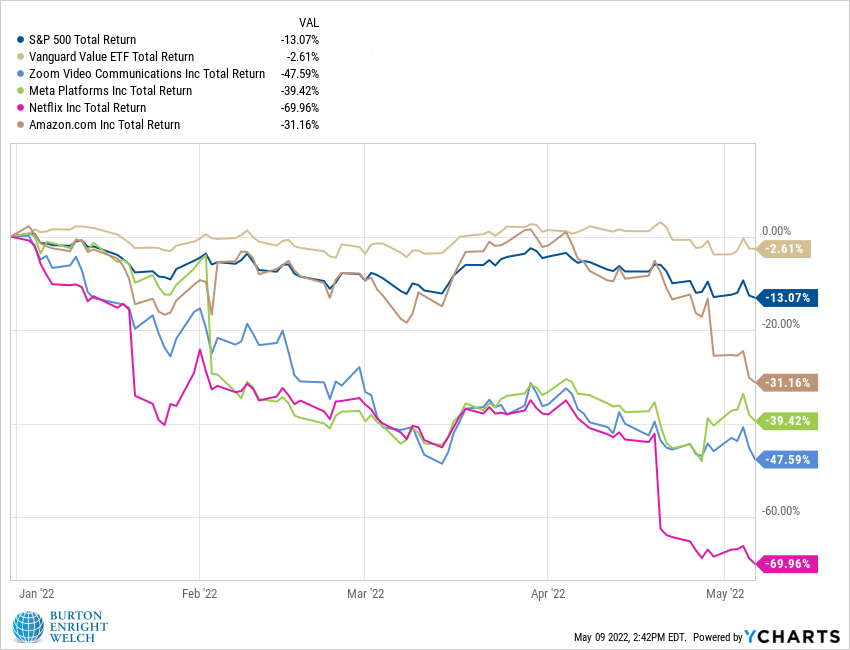

In January, we wrote about the shifting market narrative. Declines were market-wide, but particularly harsh in tech stocks.

That trend has continued. Many of the most prominent, popular names of the past years have taken a beating this year.

There are no shortage of culprits – high inflation, the war in Ukraine, Covid shutdowns in China, etc.

Today, we’ll focus on one that is a bit tricky to understand – the U.S. Federal Reserve (the Fed).

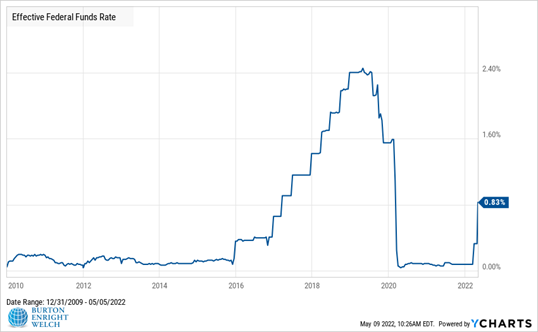

One of the Fed’s main powers is raising and lowering its interest rate. Rates all over the economy, including for bonds, respond to the Fed rate.

This year, the Fed has increased rates by 0.75% and signaled that more hikes are likely.

In turn, a U.S. 10-year Treasury bond started 2022 paying 1.5% and has shot up to 3.1%. In January, an investor who put $1,000 into 10-year Treasuries would earn $150 in interest over the decade. Today, that investor can purchase a new 10-year Treasury bond and earn $310.

On a nominal basis, Treasury bonds are risk-free. So, they are a useful look at the opportunity cost of owning stocks.

Instead of a Treasury bond, an investor can buy a tech stock that expects no near-term profits or dividends. When rates are low, that investor foregoes little income. When rates rise, the stock’s returns must clear a higher hurdle to justify the investor’s risk.

The stock universe features a similar tradeoff. Growth stocks depend on long time horizons and exponential expansion. Other stocks feature dividends and more modest assumptions. These are often called “value stocks.”

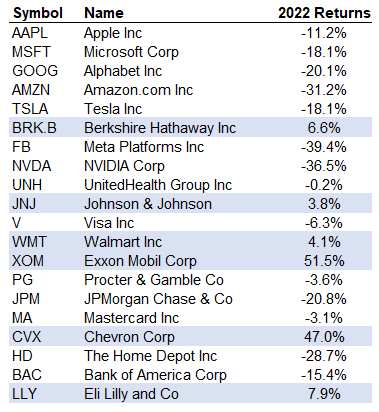

Value stocks have held up better this year. Case in point, below are the largest U.S. companies and their returns through Friday. Highlighted in blue are stocks that have positive returns. They are mature companies that pay dividends.

With low rates, investors prefer stories about the future over earnings today. When rates rise, investors begin to prefer earnings today over stories about the future.

Growth stocks (stories about the future) have been ascendant for well over a decade. Not coincidentally, this coincided with a historically low Fed rate.

In recent years, we have pushed our portfolios toward stocks that rely more on their near-term business outlook and less on stories about the future. If the Fed rate continues to elevate, we expect this orientation to produce relatively better results, as it has so far this year.

One final point – rising rates do not automatically translate to poor stock market performance. The S&P 500 has produced positive returns in every rising rate period over the last three decades.

Rather, rising rates change the math behind how investors value stocks and as a result the complexion of which types of stocks perform well.

Fed policy is a story that merits close attention in the coming months.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.