Introduction

Think you’re a savvy investor? If you answered yes, you wouldn’t be alone.

Investors have a high opinion of themselves. One study found that 64% of investors rate their investment knowledge high. Yet, research shows that the average investor consistently underperforms the market by about 2% to 3% a year.

But what if we’re measuring investment success all wrong? What if instead of chasing market-beating returns or cocktail party bragging rights, true investment success was measured by your ability to systematically build wealth to achieve what matters to you, whether that’s a secure retirement, sending your children to college, or creating generational wealth?

Through this lens, the markers of success look different. Let’s break down the key behaviors that distinguish disciplined wealth builders from the crowd. Just as importantly, we’ll explore the warning signs that may indicate that your investing needs a different approach.

Signs You’re Making Smart Investment Decisions

- You’re Boring and Lazy (In a Good Way)

Warren Buffett famously said his favorite holding period is “forever.” While others chase the latest trends in crypto, successful investors often maintain surprisingly simple (and boring) portfolios.

Investors who check their portfolios daily make worse investment decisions and earn lower returns than those who review quarterly. In fact, there’s an infamous anecdote that Fidelity once conducted an internal review of investor performance and made a comical discovery — the top performers forgot they had an account at Fidelity.

Even professional investors fall into the trap of trying to do too much, with 85% of professional fund managers failing to outperform the S&P 500 over 10 years. One study found that active traders not only underperform buy-and-hold investors but also take on higher volatility in the process. They pay more in taxes, too. According to S&P Global, the median active fund trails the S&P 500 by 3.5% a year, after tax.

Investing is like tending a garden. Success comes from planting the right seeds, maintaining good habits — and knowing when to do nothing at all. - Your Portfolio Is a Master Class in Balance

Remember those plastic plates from childhood, the ones that divided your food into neat compartments? A section was reserved for your entrée and there were slots for several sides. There was even a small section for dessert. The result was a balanced meal that made any nutritionist proud.

Strive for a similar balance in your portfolio. In addition to stocks, bonds, and cash, you may also diversify in small and mid-sized companies, own both growth and value stocks, and have exposure to global markets. The power of diversification isn’t just theoretical. During the 2007–2009 global financial crisis, a portfolio with 60% stocks and 40% bonds fell 12.2% — painful, but far better than the S&P 500’s 37% plunge. - You Understand That Being Wrong Is Part Of Being Right

Even the most successful investors make mistakes sometimes. Hedge fund manager Bill Ackerman’s well-publicized Herbalife short cost him approximately $1 billion, while David Einhorn, another successful hedge fund manager, has shorted Tesla several times over the years, only to see the stock surge 2,000% since 2017.

It’s not about avoiding mistakes at all costs. It’s about building a portfolio that can withstand the occasional slip-up.

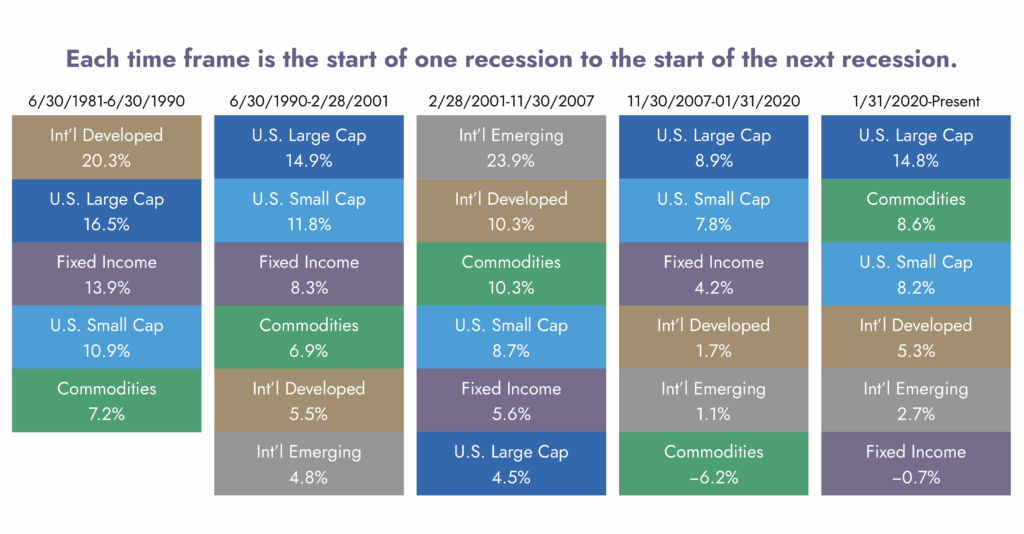

That’s where asset allocation comes in. Different asset classes shine at different moments, while others lag. From 2020 to 2024, U.S. large caps dominated, delivering a return of 14.8%. But from 2001 to 2007, the script was flipped entirely, and U.S. large caps gained just 4.5% while emerging markets soared 23.9% and commodities jumped 10.3%. Rather than trying to predict these shifts, successful investors stay diversified across multiple categories — just in case. You could put this principle in practice by including these different asset classes:

• U.S. stocks: Large-cap, mid-cap, and small cap

• International stocks: All sizes

• Bonds: Investment-grade and high-yield

Alternately, you can opt for all-in-one funds, which are broadly diversified offerings that set a target asset allocation and maintain it through regular rebalancing. - You Think in After-Tax Returns

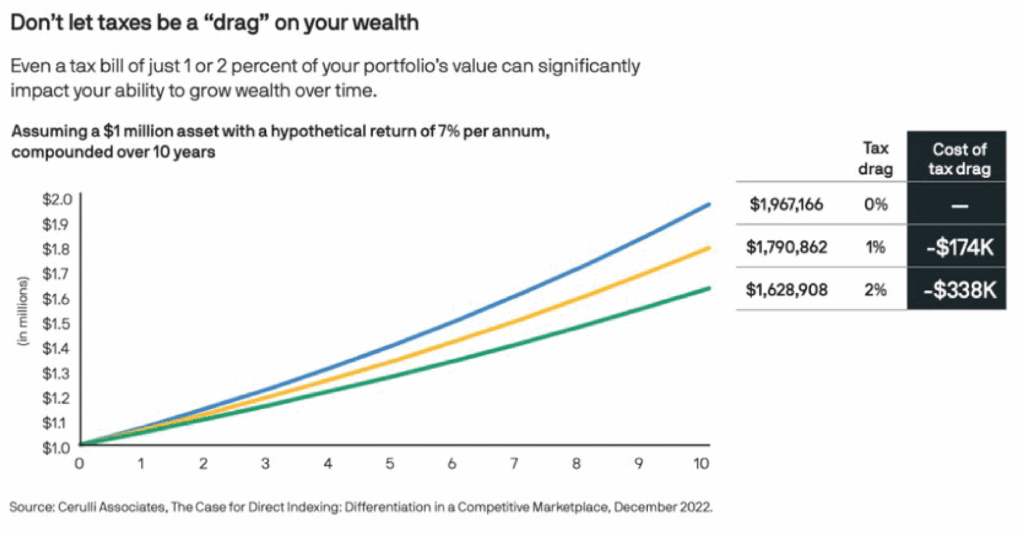

You know what they say: It’s not what you make, it’s what you keep. Tax considerations should be woven into every aspect of your investment strategy, from asset selection to the type of account you choose to the timing of trades. While you should never let the tax tail wag the investment dog, being mindful of tax implications can help you keep more of what your money earns.

Successful investors rely on a number of time-tested strategies to maximize their after-tax returns without compromising their core investment principles. Here are a few to consider:

- Tax-loss harvesting: Systematically sell off securities that have dropped during market downturns to offset gains elsewhere in your portfolio. Just be mindful of wash-sale rules.

- Tax-sheltered accounts: Take advantage of tax free compounding through vehicles like Roth IRAs and 529 plans when appropriate.

- Asset location: Some types of investments are better suited for different types of accounts. For instance, bonds, whose income is taxed at ordinary tax rates, are a better fit for tax-advantaged accounts. Growth stocks, whose returns consist mainly of capital gains, are a good fit for taxable accounts.

- Limiting trading: Selling appreciated securities in less than a year makes gains taxable at ordinary income tax rates of up to 37%. Securities sold after a year, though, are taxed at a more favorable capital gains rate.

- Tax-loss harvesting: Systematically sell off securities that have dropped during market downturns to offset gains elsewhere in your portfolio. Just be mindful of wash-sale rules.

- Your Strategy Passes the Sleep-At-Night Test

The ultimate test of a sound investment strategy isn’t found in a spreadsheet or performance chart. It’s in your ability to sleep peacefully during market turbulence. When the market plunges 20% or your favorite stock drops 40% in a single day, is your reaction panic or is it the calm acknowledgment that this is simply part of the investing process?

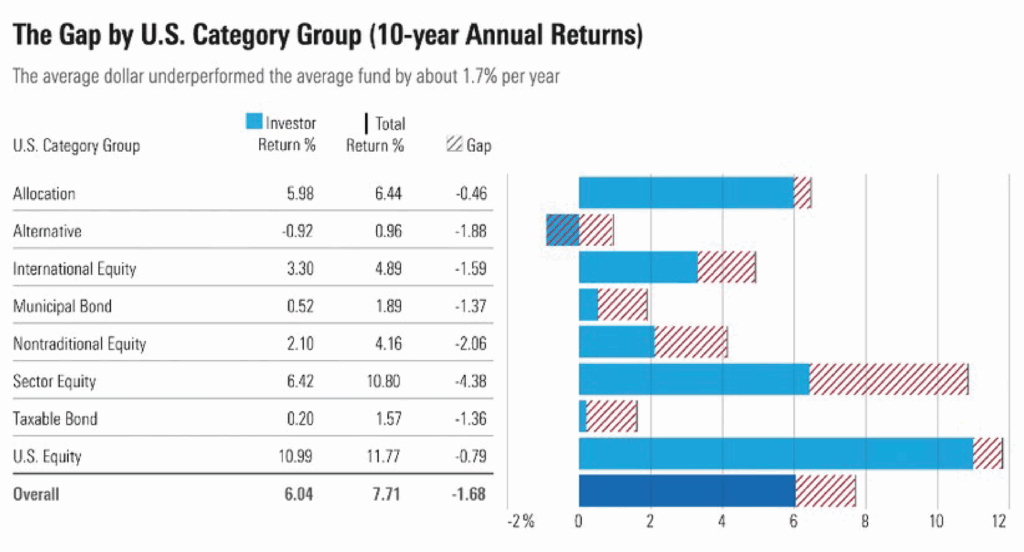

If you’re like most people, it’s the former. Morningstar reports that emotions are costing investors 1.7% in return each year. But if your portfolio is aligned with your true risk tolerance and is well-diversified, it can help you weather the ups and downs.

The biggest threat to your investment returns isn’t market volatility. It’s your reaction to that volatility. - You Know to Ask for Help When You Need It

Can you invest on your own? Of course. But like a major trek, your journey can be less stressful and perilous with an experienced guide by your side.

Working with a financial advisor can add 3% or more in net returns annually, through strategies like:

- Tax efficiency

- Behavioral coaching during market stresses

- Asset allocation strategies

- Rebalancing

- Tax efficiency

The Red Flags: 3 Signs You Might Be Off Track

- Your Strategy Changes More Often Than Your Socks

If you’ve jumped from value investing to growth stocks to crypto to real estate in the past year, you might be chasing returns rather than building wealth. Constant strategy-hopping can lead to buying high and selling low — the exact opposite of successful investing.

Consider adopting an investment policy statement (IPS), a formal document that serves as your personal road map for investing. An IPS helps you stay focused on long-term objectives so you can stay consistent in your investing.

An IPS includes:

- Your goals and time horizon

- Target asset allocations

- Risk tolerance

- Conditions for rebalancing

- Investment preferences and restrictions

- Criteria for selecting and monitoring investments

- Your goals and time horizon

- You Can’t Explain Your Strategy to a 10-Year-Old

During the 2007–2009 global financial crisis, even seasoned Wall Street executives struggled to understand their own portfolios of synthetic credit default swaps and other mortgage-linked securities.

When congressional committees asked bank CEOs to explain these instruments, many couldn’t provide clear answers. The result? $10.8 trillion in lost stock market value (adjusted for inflation). Complexity often leads investors to chase performance, buying specialized funds at peak valuations. Vanguard founder John Bogle popularized the idea of simplicity in investing. He even favored a three-fund portfolio consisting of a total market U.S stock fund, a total market international stock fund, and a total market bond fund. - You Think You Can Outsmart the Market

If you find yourself saying things like, “I’ll buy back into the market when things settle down” or “I’m waiting for the perfect entry point,” you might be falling into a market timing trap. Research shows that missing just the 10 best market days over a 20-year period could cut your returns in half.

Instead, stay invested through market cycles and use dollar-cost averaging to reduce the impact of volatility. This means investing a fixed amount at regular intervals — say, $5,000 every month — regardless of market conditions. When prices drop, you automatically buy more shares and when they rise, you buy fewer. Dollar-cost averaging helps you avoid the psychological pitfall of trying to outsmart the market.

Next Steps: Turn Knowledge Into Action

The best investment strategy isn’t the one that makes the most money in any given year. It’s the one you can stick with through market cycles while still making progress toward your goals.

Ready for an expert perspective on your investment strategy? Schedule a free consultation with us. We’ll help you evaluate your current approach and identify opportunities to strengthen your financial future.

Sources:

1 FINRA Foundation, “Investors in the United States: The Changing Landscape”

2 Index Fund Advisors, “Dalbar QAIB 2024: Investors are Still Their Own Worst Enemies”

3 Journal of Banking & Finance, “Myopic loss aversion and stock investments: An empirical study of private investors”

4 S&P Global, “SPIVA | S&P Dow Jones Indices”

5 Ilia D. Dichev and Xin Zheng, “The Volatility of Stock Investor Returns”

6 S&P Global, “SPIVA®After-Tax Scorecard: The Effect of Taxes on Indices and Active Funds”

7 Chartered Alternative Investment Analyst Association, “The Spectacular Past and Concerning Future of the 60/40 Portfolio”

8 Northwestern Mutual, “The Best and Worst Asset Classes in 2024 and the Key Risk Some Investors May Be Missing”

9 Morningstar, “Bad Timing Costs Investors One Fifth of Their Funds’ Returns”

10 Vanguard, “Quantifying the evolution of advice and its value to investors”

11 Federal Reserve Bank of St. Louis, “Household Financial Stability: Who Suffered the Most from the Crisis?”

12 J.P.Morgan, “Back to school: 3 principles for your portfolio”

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.