Early retirement is daydream-worthy: more time for family, travel, or finally pursuing the passions you’ve put on hold. But before you turn in your work laptop and office badge for good, it’s important to ask the tougher questions.

Is it smart to stop working when you’re making more than ever before?

Will your savings stretch for 30 or even 40 years?

How will you cover health insurance before you’re eligible for Medicare?

And perhaps most importantly, what will give you purpose when work no longer fills your calendar?

These questions separate an impulsive leap from a smooth transition. Let’s tackle the financial, health care, and lifestyle factors that determine whether early retirement becomes your best decision — or one you regret later.

The Financial Realities of Early Retirement

Early retirement is a balancing act across multiple fronts, and each one comes with its own challenges.

Will Your Savings Last Long Enough?

Your retirement fund has to last longer than most. That means higher savings rates before retirement and more careful withdrawal strategies once you’re living off your portfolio.

Sequence of returns risk — where market downturns during early retirement can hurt the longevity of your retirement savings — is especially important for early retirees.

Stress-testing different scenarios helps you see whether your plan holds up when markets don’t cooperate with your timeline.

How Will You Access Retirement Income Before 60?

Tapping retirement accounts before age 59½ typically triggers IRS penalties, and Social Security benefits aren’t available until age 62 at the earliest.

That means you’ll likely rely on flexible sources of income — like taxable brokerage accounts, Roth ladders, deferred compensation plans, or even part-time work — to fund your early years of retirement. Coordinating the order of withdrawals across taxable, tax-deferred, and tax-free accounts is key to maximizing after-tax retirement income.

How Will You Cover Healthcare Costs?

Medicare doesn’t begin until 65, which leaves early retirees footing the bill for health insurance in the meantime. Marketplace plans, COBRA, spousal coverage, or part-time work with benefits can help fill the gap — but premiums can run tens of thousands of dollars per year for Bay Area families.

Even once Medicare kicks in, it doesn’t cover everything. Out-of-pocket expenses, supplemental coverage, and long-term care planning all need to be part of the equation.

What Kind of Lifestyle Do You Want to Lead?

Retiring early opens up years of possibility — travel, hobbies, family, or even a second act in consulting or entrepreneurship. But those choices carry costs, and in many cases, those costs are highest early in retirement.

Building a plan that accounts for higher discretionary spending in the early years and tapering later helps align your finances with your actual lifestyle.

In short, your early retirement plan should withstand more than just the “average” scenario. So let’s explore how you can account for each of these ever-changing factors.

Stress-Testing Your Savings and Withdrawals

It’s a seemingly simple but, in practice, cumbersome question: Do you have enough money to retire early?

Most retirement calculators spit out a neat number: save x dollars, withdraw y% per year, and you’re set for life. We all know life isn’t that predictable. Markets decline. Health care needs occur when you least expect it. Family obligations pop up.

Retiring early only magnifies these risks because your money has to last longer.

That’s why early retirement planning should account for a range of outcomes to stack the odds in your favor.

Sequence of Returns Risk

A $3 million portfolio can look bulletproof on paper, but if a bear market hits in your first years of retirement, that kevlar vest suddenly becomes more penetrable.

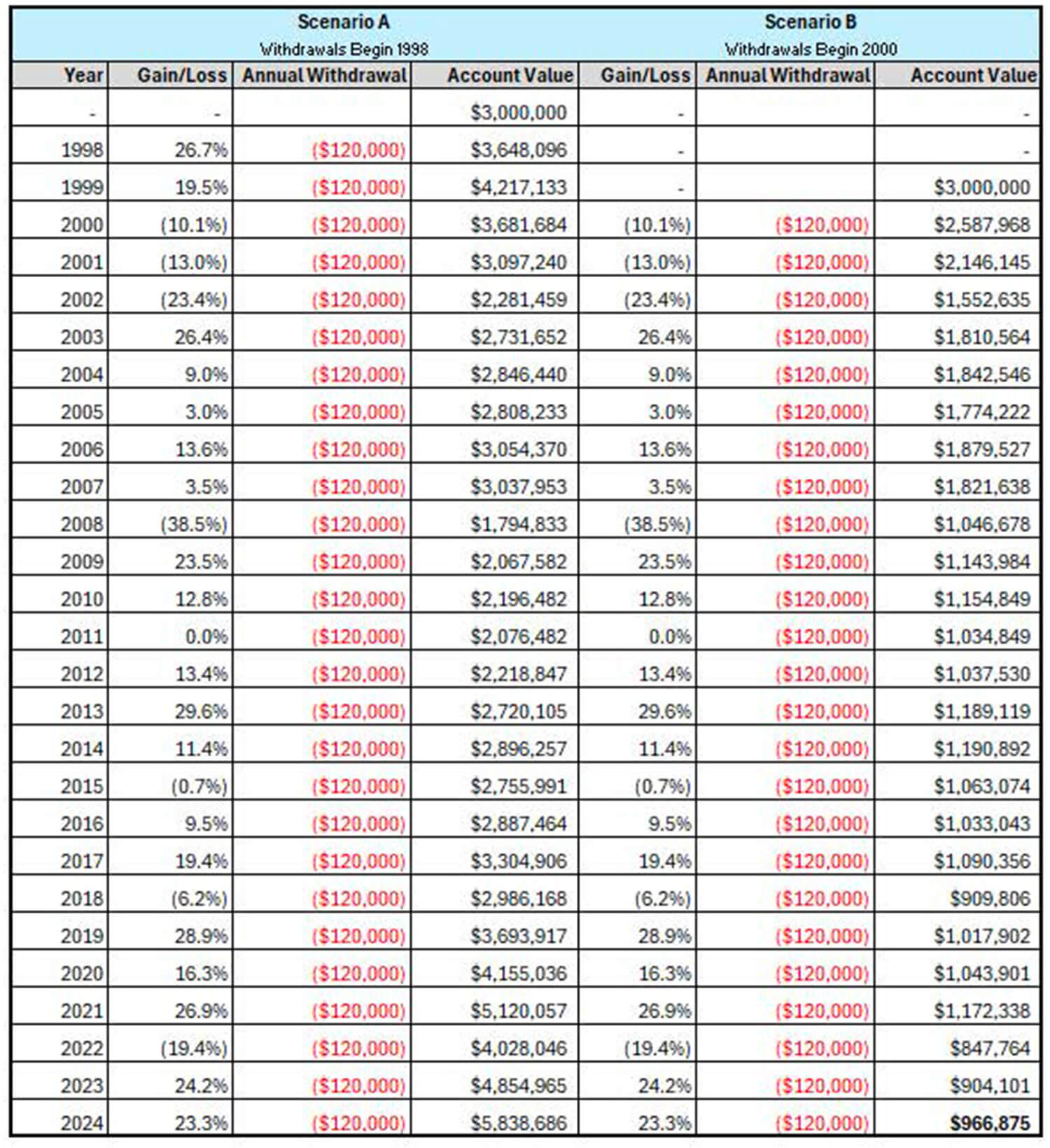

Let’s compare two early retirees with identical portfolios: each starts with $3 million, withdraws $120,000 annually, and earns the same returns over time.

The only difference? Timing.

Retiree A begins withdrawals in 1998, just ahead of two strong years in the market. That early momentum helps cushion the portfolio through later downturns.

Retiree B begins in 2000, right as the dot-com crash takes hold. The combination of withdrawals and early market losses hammers their balance — so much so that even the strong recovery years that follow can’t make up the ground.

This “sequence of returns” risk means early losses can compound into lasting damage.

The lesson: the order of returns in your first years of retirement can matter more than the average return over your entire retirement. A difference of just a couple years in start date can mean the difference between preserving millions or running out of money far too soon.

But how are you supposed to time your retirement to avoid a bear market? Unfortunately, you can’t.

That said, you can stress-test your portfolio, which means modeling scenarios where initial withdrawals occur during periods of market downturn, to ensure your plan stands up to strenuous conditions.

The next step is building an allocation that can weather downturns without disrupting your income. That typically means starting with a traditional 60/40 mix of stocks and bonds, then tailoring it to individual circumstances — dialing growth up or down depending on your risk tolerance, income needs, and retirement goals.

Protect your portfolio with guardrails

Another way to protect your withdrawals is by using a “guardrails” strategy. Instead of sticking with a fixed percentage every year, you set upper and lower limits that trigger adjustments.

Here’s how it works:

- If your portfolio grows faster than expected, you can increase withdrawals, enjoying more income while staying safely within set parameters.

- If markets underperform and your portfolio drops below the lower guardrail, you temporarily tighten spending, preserving assets until markets recover.

Guardrails give you a dynamic system that adjusts with volatility, rather than relying on rigid projections. For early retirees facing decades of unknown, it’s a way to keep income sustainable without living in constant fear of overspending.

Accessing Sustainable Retirement Income

Even the best withdrawal strategy won’t work without reliable sources of income to draw from. And the IRS isn’t exactly friendly to early retirees.

Most retirement accounts are off-limits until age 59 ½ without incurring a 10% penalty, and Social Security benefits aren’t available until at least 62. That means if you retire in your 50s, you could face several years of funding your lifestyle without leaning on the accounts you’ve been building for decades.

Financial flexibility is imperative for early retirees, who often must rely on a mix of:

- Taxable brokerage accounts: These accounts don’t have age restrictions, making them ideal for covering expenses before retirement accounts are accessible.

- Roth IRA conversions: By converting traditional IRA assets into a Roth gradually over time, you can create a stream of tax-free withdrawals in later years — while reducing the tax bite of required minimum distributions.

- Substantially equal periodic payments (SEPPs): A lesser-known IRS rule that allows penalty-free withdrawals from retirement accounts before 59½, provided you stick to a set formula for several years.

- Deferred compensation plans: For qualifying plans, deferred comp can provide income during the early years of retirement, but timing and tax treatment require careful coordination.

- Part-time work: Many high-achieving professionals who put themselves in position to retire early often don’t actually want to stop working entirely. Any part-time income, like from consulting or a passion project, can have a major impact on the longevity of your retirement funds.

Social Security Timing

More often than not, early retirees are tempted to claim Social Security as soon as possible, which is age 62. While you can claim retirement benefits this early, doing so locks in permanently reduced checks.

For high achievers with other income sources, delaying Social Security until full retirement age (66–67 for most) or even 70 can significantly increase lifetime benefits — and provide a more stable income stream later in retirement. Of course, this is a highly personal decision that should account for your broader financial picture and post-career plan.

Covering Healthcare Costs Before Medicare

Health care is arguably the single biggest wild card in retirement, because health is truly unpredictable. For early retirees, there’s an added wrinkle: maintaining adequate coverage without paying outrageous premiums until Medicare eligibility.

That’s age 65, which means anyone leaving work before then faces a potentially expensive coverage gap. Early retirees usually find coverage from a few common sources:

- ACA marketplace plans: The normal go-to, but premiums and subsidies depend heavily on income.

- COBRA: Extending employer coverage for up to 18 months, though often at higher costs since you’re footing the entire premium.

- Spousal plans: If your spouse is still working, joining their employer-sponsored coverage is likely the most efficient route.

- Part-time work: Some employers still offer health benefits to part-time employees (the bump in annual income doesn’t hurt either).

Even once Medicare begins, it doesn’t cover everything. Out-of-pocket expenses, supplemental insurance, and long-term care can hinder retirement budgets. To reduce exposure to this risk, plan early — whether through long-term care insurance or simply setting aside assets in an HSA.

The Role of HSAs

If you’re eligible to contribute before retiring, a Health Savings Account (HSA) can provide valuable flexibility. Contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are also tax-free. It’s a win-win-win.

Planning for Lifestyle Considerations

If I were to ask you to picture early retirement, what do you see? Perhaps beaches, bucket-list trips, or long stretches of leisure without the Monday-to-Friday grind. Those things can be wonderful, but for many ambitious individuals, they’re not enough to power a multi-decade retirement.

One of the biggest risks of early retirement isn’t financial at all; it’s waking up without purpose and suddenly wondering if you made a mistake.

Replacing the Structure of Work

Work provides far more than income. It delivers routines, structure, and social interaction. Retiring early can feel liberating at first, but more often than many realize, retirees struggle with a loss of direction once the novelty fades.

Without a plan to replace those anchors, boredom and even depression can creep in.

Part-Time Work or Consulting

For Type-A professionals, scaling back instead of stepping away often strikes the right balance. Consulting, board service, or starting a small venture allows you to keep your skills sharp, maintain networks, and generate supplemental income — all while enjoying more flexibility.

Front-Loaded Spending

Lifestyle choices also carry financial consequences. Early retirement years typically involve higher spending on travel, hobbies, or supporting family. That’s not necessarily a problem, as long as it’s anticipated.

Modeling a “spending smile” (higher expenses early on, tapering in mid-retirement, with a rise again for health care later) helps align resources with your actual lifestyle.

Finding Purpose After the Last Paycheck

Not every retiree wants to keep working. Many find fulfillment through volunteering, mentoring, or doubling down on family and community. What matters most is being intentional with your sudden abundance of time.

How a Financial Advisor Helps You Avoid Regret

Retiring early may be the biggest financial decision of your life — and one of the most personal. Balancing income needs, tax strategies, healthcare costs, and lifestyle goals is no small feat. For type-A professionals who are used to handling everything themselves, it can feel tempting to plan everything alone. But early retirement is one area where outside perspective can save you from costly missteps.

Here’s what the right advisor brings to the table:

Scenario modeling. Advisors can run detailed simulations, stress-testing your plan against bear markets, higher healthcare costs, or longer-than-expected lifespans.

Withdrawal and tax coordination. From Roth ladders to charitable giving, a well-sequenced withdrawal strategy can mean the difference between overspending and stretching your savings decades longer.

Portfolio alignment. Fiduciary financial planners can design a portfolio that meets your exact needs, helping rebalance concentrated equity positions and design diversified income-producing portfolios.

Healthcare and insurance planning. Advisors can coordinate Medicare timing, bridge coverage before 65, and factor long-term care into your broader wealth strategy.

Sounding board support. It’s not all financial advice. Just as importantly, a trusted advisor helps you think through the identity shift of leaving work behind — asking the right questions and helping you step into a purpose-driven Life After Work.

The combination of financial planning, technical expertise, and human perspective is what helps turn the idea of early retirement into a sustainable reality.

Plan Now, Retire Early, Live Fully

Money is the enabler, not the destination. The retirees who thrive in their Life After Work are those who pair financial independence with a clear sense of what they’re retiring to — not just what they’re retiring from.

At BEW, we call this shift Life After Work — the stage where your career success fuels the next chapter of purpose and financial freedom.

Ready to explore what your own Life After Work could look like? Download our free guide, Retirement Redefined: Your Guide to Life After Work.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.