As we look ahead to 2026, we want to share an update on retirement contribution limits and an important rule change taking effect next year. The 2022 SECURE 2.0 Act’s new Roth catch-up requirement for high earners will go into effect. Plan sponsors were granted additional time to implement the change.

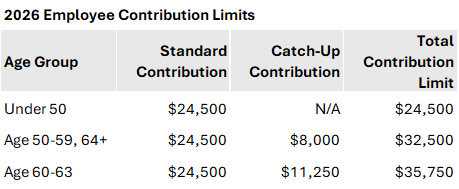

401(k) and 403(b) Contribution Limits for 2026

For 2026, employees may contribute up to $24,500, an increase from $23,500 in 2025. Individuals aged 50 and older are eligible to make catch-up contributions of $8,000 for a total employee contribution of $32,500.

“Super Catch-Up” Contributions for Ages 60-63

SECURE 2.0 also introduced an enhanced catch-up contribution for participants turning ages 60-63. Those who turn 60, 61, 62, or 63 in 2026 may make a catch-up contribution of $11,250 for a total contribution of $35,750. This replaces the standard $8,000 catch-up amount and applies only during the calendar years you end aged 60-63.

Mandatory Roth Catch-Up Contributions for High Earners

Beginning in 2026, individuals aged 50 or older who earned more than $150,000 in the prior year must make Roth catch-up contributions to their employer retirement plan. The $150,000 income threshold is based on Social Security FICA wages (Box 3 on Form W-2) and considers wages from your current employer only.

Since Roth contributions are made with after-tax dollars, you do not get a tax deduction in the year you make them. Future growth and distributions will be tax free.

Year-End Action Items

As part of your year-end planning, we recommend reviewing your current retirement contribution elections to ensure they align with the new 2026 limits.

For those subject to the new Roth catch-up rule, we also recommend checking with your employer or retirement plan sponsor to understand how Roth catch-up contributions will be administered by your plan and whether any action is required on your part. Some plans may require an updated contribution election or explicit Roth designation to continue making catch-up contributions in 2026.

As always, if you have questions or would like to discuss how these changes fit into your broader retirement savings strategy, please reach out to your BEW advisor.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.