I. Nvidia and Your Portfolio

In every bull market, a stock breaks into the zeitgeist. Earnings announcements are major stories. The CEO achieves first-name celebrity status. Friends and family (especially if you are a financial advisor) ask “did you see what it did today?” and “should I buy some?”

A few years ago, it was Tesla. This bull market, it is Nvidia.

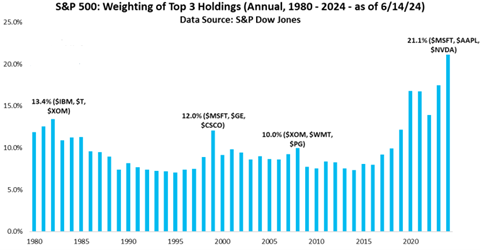

At its peak, Nvidia’s $3.4 trillion market cap (the total value of all its stock), overtook Apple and Microsoft to become the S&P 500’s most valuable company (Microsoft has since retaken the crown). The three tech behemoths now comprise a fifth of the S&P 500.

Since 1950, just seven (!) other companies have topped the S&P 500: AT&T, IBM, ExxonMobil, GE, Microsoft, Apple, and Amazon. Nvidia is more valuable than the broad stock indices of Germany, France, and the United Kingdom.

Just five years ago, Nvidia was not even in the S&P’s top 60. Three years ago, it was tenth. Then in November 2022, ChatGPT launched (decades from now this event may be known as the dawn of the Artificial Intelligence (AI) era). Since then, Nvidia has gained nearly $3 trillion in value!

Nvidia sells the computer chips that power the AI platforms trying to keep up with the world’s exploding AI demand. Even with the AI boom barely starting, Nvidia is already massively profitable.

These massive profits curb concerns that the AI boom is repeating the dot-com tech bubble.

Still, the leading companies present interesting parallels. Nvidia is up 3400% over the last five years. Cisco rose 3500% in the five years up to its March 2000 peak. Both sold infrastructure that global companies gobbled up to meet insatiable construction demand. And both overtook the same company to become the world’s most valuable – Microsoft.

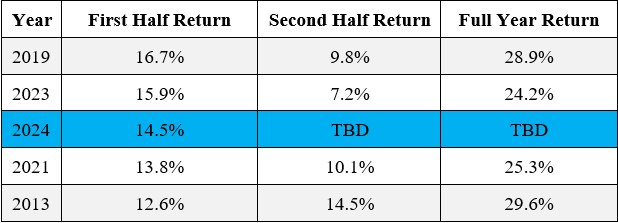

Nvidia has helped spur the current bull market. This century, only 2019 and 2023 delivered better first halves for the S&P 500.

Nvidia has also spurred returns in our portfolios. It is easy to miss this amidst your accounts’ roster of anonymous funds and ticker symbols.

Our funds hold hundreds and thousands of positions. This broad diversification leads to tiny percentages in each stock. Still, the top holdings are meaningful.

Nvidia features prominently in two of the funds we often own.

As most know, we do not pick stocks, i.e., buy individual companies. For the most part, we aim to capture the markets’ returns, which have historically been more than sufficient to meet our clients’ financial plan goals.

Nvidia and AI are the latest and greatest examples of the energy our strategies try to capture – capitalism’s perpetual drive toward improvement, evolution, and value-creation. We see no reason why that theme will abate.

Through our diversified approach, our clients have participated in Nvidia’s meteoritic rise over the last decade. They will also benefit from the next pioneering companies that emerge from obscurity into the zeitgeist.

II. FPA NorCal

The Financial Planning Association’s annual San Francisco conference is one of the largest and most well-known gatherings of financial planners.

We thought we’d pass along some of this year’s highlights:

- Tax Planning: The Tax Cuts and Jobs Act sunsets at the end of 2025. Examples of tax planning ideas include (a) accelerating taxable income before tax rates rise and (b) capturing the full $14 million per person gift and estate tax exemption before it halves.

- Inherited IRAs: The inherited IRA rule that began in 2020 requires most non-spouse beneficiaries to fully liquidate inherited IRAs within 10 years. Families with beneficiaries in high tax brackets may want to consider strategies to limit the tax impact.

- Equity Compensation: We explored approaches to consider when trying to reduce the single-stock concentration for those with significant equity-based compensation plans.

- Home Equity: Home equity is a significant, difficult to tap resource for retirees, particularly in California. We reviewed strategies for leveraging home equity to maintain financial stability in retirees’ later years.

- Small Business Planning: We deepened our knowledge in business entity formation so that we can support our entrepreneurial clients through their business lifecycle.

- Technology: Many “fintech” startups attend to demo software for advisors. We are auditioning a few tools we saw, including notetaking, healthcare plan consulting, and equity plan compensation tracking.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.