Before we discuss today’s news that we have officially entered a bear market, we came across an amusing and telling chart.

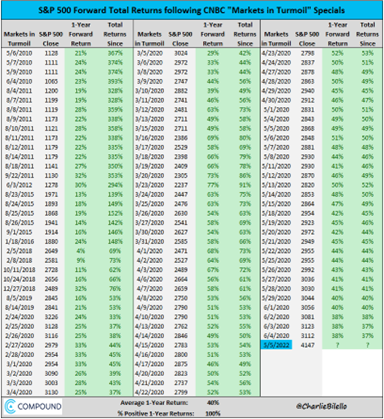

CNBC has a “Markets in Turmoil” special report they roll out in times like this.

It may be the most reliable forward indicator in recent market history.

The above reveals a sound principle – down markets set the stage for future returns. The stock market is like a yo-yo on an escalator. A decline doesn’t alter the destination. It increases how much the market will eventually climb.

Granted, “eventually” does a lot of heavy lifting. Unlike downturns during the past decade, “eventually” may take an uncomfortably long time. Any investor who remembers the Dot-Com Bubble or Great Recession can attest to that.

This is the fifth time since 2012 that the S&P 500 has declined by more than 10% (“Corrections”). In the previous four, it took mere months to return to its previous high.

Already, we can see that this decline is different. The previous corrections had recovered by now or were on the path to doing so.

With today’s close, the S&P 500 has officially entered a bear market (down 20%). This is the fourth bear market this century, following the Dot-Com, Great Recession, and Pandemic bears.

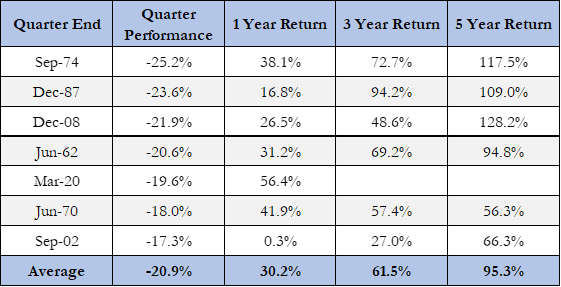

While it has been a tough year overall, this quarter has been particularly rough. Since April 1, the S&P 500 has fallen 17.5%. If we ended the quarter today, it would be one of the worst quarters of the last 70 years. Here are the others:

Once again, we see that long-term post-decline returns were strong. If you look ahead five years, the average result is a near doubling in value, about 25% higher than the S&P 500’s average five-year return.

Crashes always feel like opportunities in retrospect and like risks in the present.

Because the day-to-day experience of a bear market is so draining, investors need to absorb the glass-half-full case to remain fortified.

“Volatility tests your emotions and intestinal fortitude. Extended downturns test your patience and resilience.”

— Investor Ben Carlson

“The market is the most efficient mechanism anywhere in the world for transferring wealth from impatient people to patient people.”

— Warren Buffett

Bear markets are inevitable and unavoidable. The best tools to traverse them are an investment plan and a long-term perspective.

We are prepared to help you bolster yours. Please let us know if you would like to meet to review your long-term plan.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.