With a year as dismal as 2022, it’s natural to want to assign blame: inflation, the Fed, war, etc.

Eventually, history will appoint a primary cause. Perhaps 2022 will become the Great Inflation or the Post-Pandemic Hangover.

In any event, the best and simplest answer may also be the least dramatic and fulfilling – markets fell a lot because they went up too much in the first place.

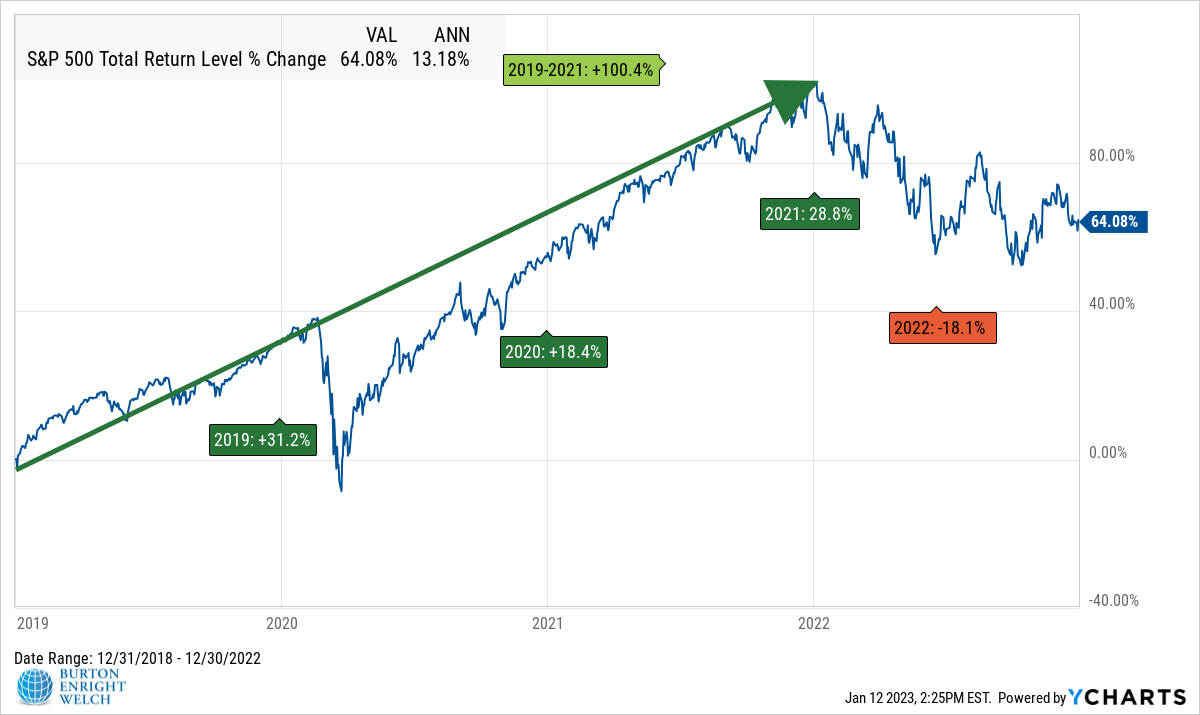

In isolation, 2022 looks grim. The S&P 500 had its fourth worst year since 1950.

However, if we summon the preceding years, 2022 loses some of its potency.

The S&P 500’s 13.2% annualized return over the last four years is not far from the roughly 10% long-term average return for U.S. stocks. It’s rare for any one year’s return to be around 10%. Rather, investors earn long-term returns through this three-steps-forward, one-step-back cadence.

For 2022, the one step back felt more like a rug pull. Past years’ strong trends reversed, and cold water drenched overexuberant parts of recent markets.

In a story as old as time, many investors overlearned recent history and forgot that the only inevitability is that the pendulum will swing.

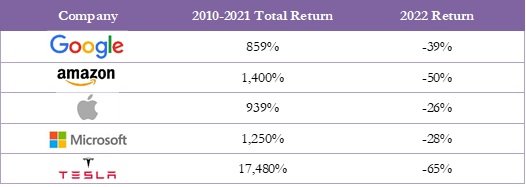

Mega-Cap Tech Stocks

Tech giants have led the market since the Great Financial Crisis. Their consistent and outsized returns produced a sense of infallibility.

Alphabet (Google), Amazon, Apple, Microsoft, and Tesla ended 2021 as the world’s five largest stocks. In 2022, they lost a combined $4 trillion in value. This is about the size of Japan’s stock market, the world’s third largest.

How could a company as massive, innovative, and dominant as Amazon lose half of its value that quickly?

Amazon’s pandemic outperformance set the stage for its 2022 crash. At its 2021 peak, Amazon was a nearly $2 trillion company. Now, at close to $1 trillion, it is back down to its 2019 size. No matter how strong and high performing a company is, buying stock at an inflated price can lead to a swift and sizable loss.

World-beating stocks tend to attract investors eager to extrapolate the recent past. Greed bids prices higher and higher, until the pendulum swings. Fear replaces greed, and investors sell as indiscriminately as they bought.

Even the world’s business giants are not immune from the law of market cycles.

Crypto

Last year was such a dramatic and catastrophic year in cryptocurrencies that it’s hard to be brief.

Crypto went mainstream in 2021. Nobody knew quite what it was. Yet, many parroted the story that it would revolutionize the financial system, hedge against inflation, and replace fiat currency. Everyone had a neighbor’s nephew who was an overnight multi-millionaire.

Today, the price of Bitcoin is less than at the beginning of 2018. A boring Schwab money market fund (gold line) would have earned a higher return, albeit without the thrills and anguish along the way.

Bonds

We don’t use the term “unprecedented” lightly. Last year was an unprecedented year in the bond market.

Relative to stocks, bonds are a boring asset class. They typically chug along, providing income and perhaps some additional return depending on the interest rate environment.

Unfortunately, bonds did not have a boring 2022. The Bloomberg Aggregate Bond Index returned -13.0%. This was the index’s worst return in its 45-year history. Its previous worst return was -2.9% in 1994.

Bonds typically diversify against stock market volatility. They are a safe haven for fearful investors amid turmoil. As a result, bonds hold their value and often appreciate when stocks fall.

Last year was the first year that stocks and bonds fell by more than 10% in the same year.

Similar to tech stocks, a long-term favorable environment for bonds set the stage for a 2022 crash.

Bond portfolios appreciate when interest rates decline. Bonds had the wind at their back as rates mostly declined for forty years into 2020.

Rates increased in 2021 and then spiked in March 2022. Rising rates impair bond portfolios because previously issued bonds depreciate relative to new bonds paying higher rates.

Despite 2022’s pain, bond investors are in a better place today than a year ago. Higher rates increase the income that bonds pay. Eventually, higher income will compensate bond investors for the pain endured in 2022. Though due to 2022’s unprecedented decline, patience will be necessary.

U.S. vs. International Stocks

The pendulum hasn’t swung to the extent of tech stocks, crypto, or bonds. Yet, considering what a one-sided story U.S. vs. international stocks has been since the Great Financial Crisis, even a small reversion is noteworthy.

In 2022, the MSCI EAFE index’s -16.8% return bested the MSCI USA index’s -20.8% return. International stocks outperformed for the first time since 2017.

Also worth mentioning, outperformance happened amidst dire headlines from overseas – the war in Ukraine, energy crisis in Europe, unrest in China, etc.

Of course, last year is small solace for globally diversified investors who have watched U.S. stocks far outpace overseas stocks in the preceding decade-plus.

It was certainly no banner year for international stocks. But following a decade of underperformance, 2022 shows slight signs of a reversion.

Looking Ahead to 2023

Seasoned investors understand that they can’t expect huge gains year after year. Still, that knowledge does not immunize against the frustration and dismay of a year like 2022. We know that market analyses and long-term perspective do not solve for the discomfort of watching a portfolio decline.

We, nor anyone, know what 2023 will bring. Just as quickly as pessimism in 2022 replaced 2021’s exuberance, this year may produce a fresh narrative.

Whatever the case, we look forward to helping you stick to your plan and work through any challenges. We will see you in 2023!