Here is an excerpt of a blog post that throws cold water on the media’s infatuation with stock market all-time highs:

“On a daily basis, the S&P 500 trades at an all-time high 7% of the time and trades within 5% of an all-time high 36% of the time. This means that on 43% of all days, since the S&P 500’s inception, US large cap stocks were at or close to making new records. Anyone who tells you that new highs are abnormal or a reason to sell is a fool.”

— Joshua Brown

Those stats are eye-opening. Market highs make great headlines. But their noteworthiness belies how ordinary they are.

Market highs are unlike many other records. In baseball, the rules and eternal struggle between pitching and hitting mean that batting averages do not climb over time. Nor are there compound returns or (non-steroid) inflation in baseball. With the market, over time offense always wins.

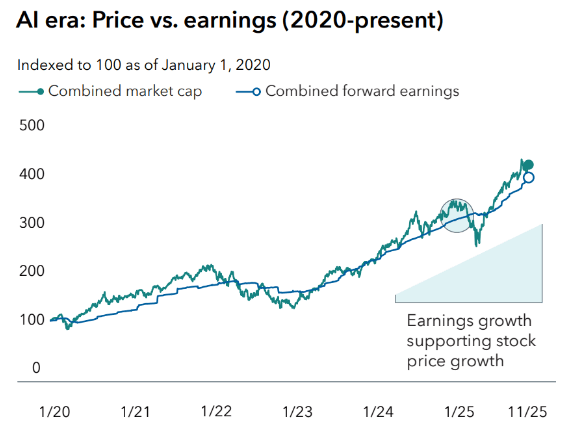

Here’s a chart that illustrates the same point the quote makes:

Highs generate an undue amount of discussion. They foster buoyant speculation about how much further the market will go. And they spark anxiety about whether the market has peaked.

And, in fact that’s what we’ve seen recently with new S&P highs and the Nasdaq finally reaching new heights after the early century dot-com boom and bust. Peak callers will occasionally be right, for a time. But don’t let that fool you about the market’s true nature and history.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.