By Alex Soderberg

Some of our clients have discovered or inherited long-forgotten paper savings bonds. Excitement turns to confusion about what to do with these antiquated investments.

We thought it would help to summarize the two main types of U.S. savings bonds, as well as what to do if you own them. Yields on U.S. Treasuries and Money Market Funds are higher (4.5% to 5.0%) than any time in the past decade. It may be prudent to redeem lower-yielding savings bonds to take advantage of current rates.

Series EE and Series I Bonds

U.S. savings bonds are a basic financial instrument backed by the full faith and credit of the U.S. government.

Many purchased them to build savings outside of retirement accounts or to gift to kids or grandkids. Often, these bonds are out of sight and out of mind. People store them in safety deposit boxes, under beds, or in file folders stuffed in rarely opened drawers. Meanwhile, these bonds compound interest for decades and may be worth more than you expect. But they also may have matured, at which point they no longer earn interest.

Series EE Bonds and Series I Bonds have many things in common: 30-year maturities, semi-annual interest payments, tax-deferred income (you pay Federal income tax on interest at redemption), state and local tax-exempt interest, and tax exclusions if used for education (depending on income levels).

However, there are key differences.

Series EE Bonds

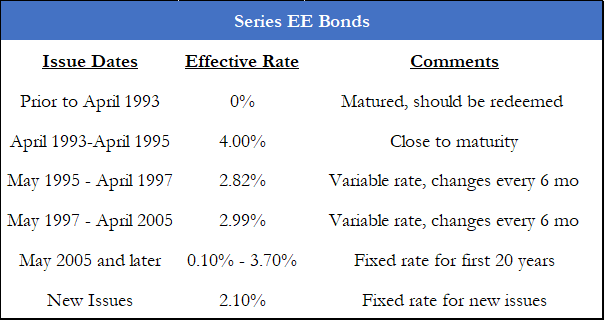

Series EE Bonds pay an interest rate based on 5-year Treasury yields. Interest rates may be fixed or variable depending on the issue date.

Here is a summary of Series EE Bond rates:

Series I Bonds

Series I Bonds grew in popularity last year. They have two separate components: a fixed rate and an inflation rate.

The fixed rate is set upon purchase. The inflation rate changes every 6 months, based on the latest inflation data. You can only purchase $10,000 of Series I Bonds per year per person.

Because inflation rose higher than 9% last year, newly issued Series I Bonds paid an annualized rate of nearly 10%. As you can see below, older Series I Bonds may still be paying over 10%. However, with new inflation numbers, the updated I Bond rate is expected to fall below 4% in May 2023, nearly a 3% rate reduction from now.

What Are My Savings Bonds Worth?

Treasury Direct provides an online tool to calculate the value of your savings bonds. You can save your list of bonds, so you don’t have to enter them again. Be warned, the website is clunky and looks like the internet from the early 2000s. Here is the link to the savings bond calculator: https://www.treasurydirect.gov/BC/SBCPrice

The calculator will tell you when the bond matures, the current value, and the interest rate.

How to Redeem Savings Bonds

Years ago, your local bank branch would redeem savings bonds for cash. However, with a rise in fraudulent savings bonds, many banks stopped handling redemptions. We recommend you call your bank to verify (1) it will redeem your savings bond, (2) how much it will redeem, and (3) what identification you need to bring.

Alternatively, you can redeem your bonds on the Treasury Direct website.

Note, if you redeem a savings bond held for less than 5 years, you will lose the last 3 months of interest.

Taxes on Savings Bonds

Interest on savings bonds is subject to federal income tax and exempt from state and local taxes. You can either report the interest each year as it accrues or opt to defer reporting the interest until you redeem the bond. Most people choose to defer. Or, you can spread redemptions and the tax impact over multiple years. We can help determine a prudent approach based on your circumstances.

Tax Exclusion for Education + 529 Strategy

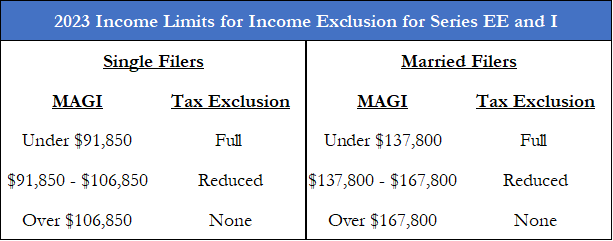

If you redeem Series EE or Series I Bonds to pay for qualified higher education expenses, you may be able to exclude the interest income from your federal income tax. To be eligible, your income must fall below certain limits, among other requirements.

For those within the above income parameters, there is an additional layer to the exclusion strategy. If you don’t have any qualified education expenses this year, you can roll bond proceeds into a 529 savings plan. You can exclude interest income and fund future college expenses.

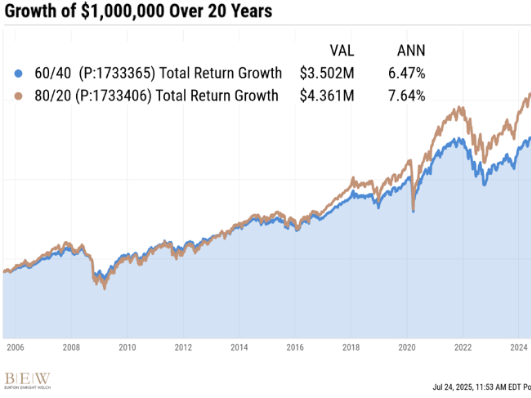

This is a particularly useful strategy to fund education for young children or grandchildren. Once proceeds are in the 529 plan, earnings grow tax-free. Within the 529 plan, you can reinvest in an asset allocation that better matches the child’s time horizon, e.g. own more stocks if college is many years away.

We’re happy to assist with this strategy if you’re curious.

Summary

While not the most exciting investing topic, paper savings bonds have provoked a lot of recent conversation. Given current interest rates, it may be time to rummage them out of their hiding spots and decide whether you can reinvest the cash more productively.

To determine the next steps with your paper bonds, enter them into the online calculator tool to create a log of your bonds. Once you have an organized log, reach out to us to discuss the best path forward.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.