2025 gave investors plenty to celebrate. It rewarded patience, discipline, and diversification. Markets delivered strong returns across an array of asset classes, many of which had spent years out of favor.

Several themes defined the strong year. International markets emerged from the shadows. Artificial intelligence (A.I.) dominated headlines. Tariffs provided a productive, short-lived disruption. And bonds quietly rebuilt confidence.

International Stocks: 2025 Standout

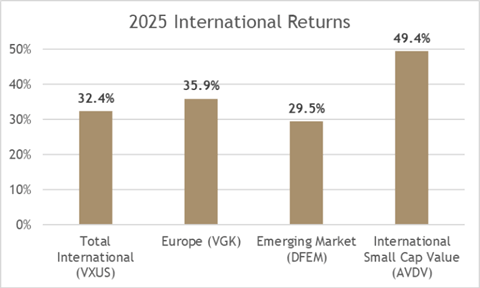

While Artificial Intelligence and tariffs captured more of the conversation, let’s lead off with our biggest story of the year — international stocks’ stellar returns. They offered long-awaited affirmation for diversified investors who stayed the course.

Europe soared after years of pessimism. Emerging markets delivered one of their strongest periods in decades. And international small-cap value — an asset class our clients own through a dedicated position — produced returns usually associated with tech stocks.

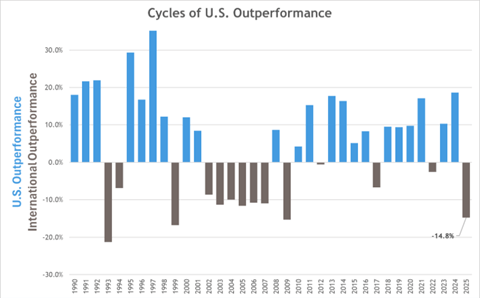

Coming into 2025, sentiment toward international stocks had never felt more dismal. Fifteen years of U.S. dominance conditioned investors to ask a fair question: why own anything other than the S&P 500?

The S&P 500 includes the world’s best run, most innovative companies. These businesses reach every corner of the global economy, capture a disproportionate share of corporate profits, and sit at the vanguard of the Artificial Intelligence revolution.

Yet, foreign stocks surged out of the gates in January. A few glimmers shifted sentiment:

- Attractive starting valuations

- Renewed fiscal investment

- Healthier-than-assumed banking system

- A weaker U.S. dollar

We’re not declaring a permanent handoff of leadership —markets rarely move in straight lines.

What 2025 did reinforce, however, is how quickly yesterday’s laggards can become tomorrow’s leaders. Since no one knows when these pivots will arrive, staying diversified is the only reliable way to participate when they do.

A.I.: Is this 1999 again?

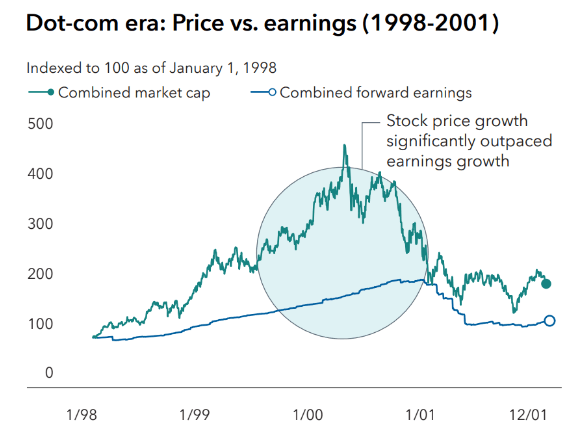

As we discussed last quarter, the media continues to compare today with the dot-com era. And we’ll join in here as well.

Just last month, Cisco reached a milestone that reminds us just how brutal the dot-com bubble burst was. Cisco recorded a new record high price … 25 years after its 2000 peak!

In the dot-com era, investors believed Cisco would be the “picks and shovels” of the internet.

And in many respects that belief wasn’t wrong. Since 1999, Cisco’s revenues quintupled, profits quadrupled, and earnings per share increased by 8x.

And yet, despite business success, shareholders endured enormous losses. The stock fell nearly 90% in the two years following its peak.

Great technology. Real earnings growth. Still a painful investment experience. As famed investor Howard Marks said, “it’s not what you buy, it’s what you pay for it.”

Today, led by Nvidia, many A.I. companies have experienced stratospheric price gains.

Yet, it’s important to note how the story differs.

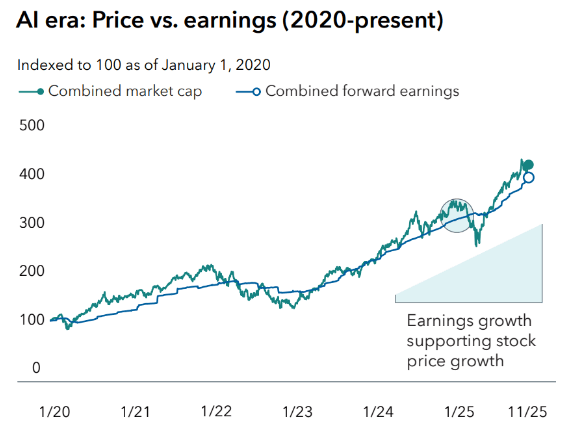

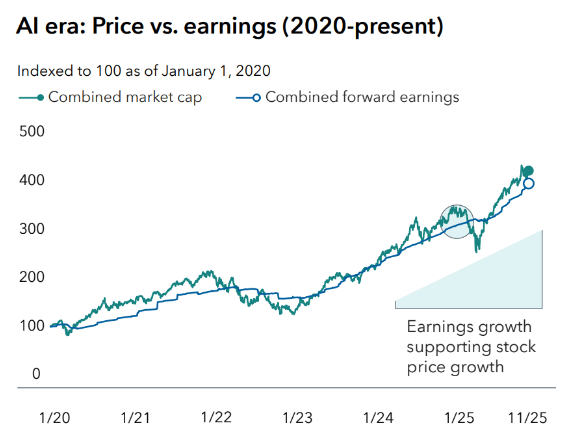

As the next charts illustrate, in the dot-com era stock prices outpaced earnings by a wide margin. Today, price increases have tracked earnings growth.

Those earnings mean today’s A.I. leaders can support their massive capital spending far better than their dot-com analogs.

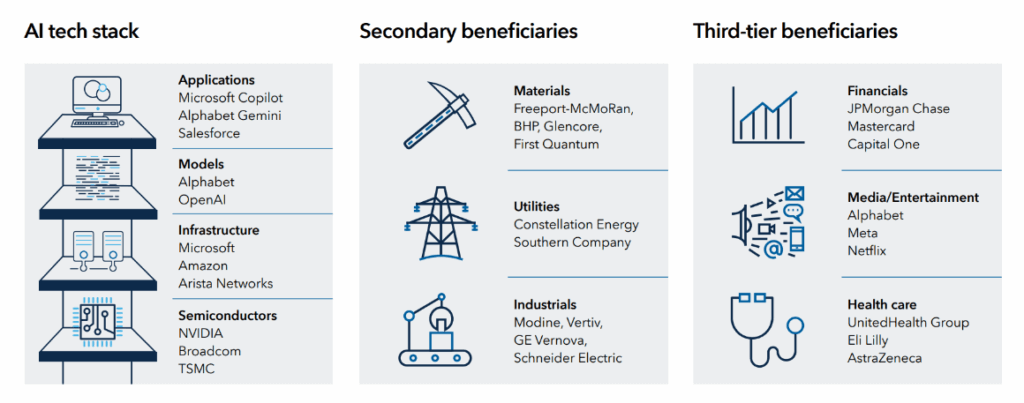

Another lesson is that A.I. isn’t just a Nvidia story. It’s an economic ecosystem story. As the next chart illustrates, A.I. investment ripples far beyond the headline names. JPMorgan Chase reported that it has saved $2 billion using A.I. to generate operational efficiencies.

This broader lens matters for two reasons:

- Value creation from technology is rarely confined to a few names. Productivity gains diffuse across industries over time.

- Market returns often show up outside the dominant narratives. Concentrating on a few presumed winners is riskier than participating in the broader ecosystem.

Where does that leave us? In a place of humility, not certainty:

- A.I. could justify high valuations if it meaningfully boosts productivity and profits over the next decade.

- It’s possible that some stocks are priced for perfection and could disappoint.

- No one — not analysts, algorithms, or media narratives — can reliably tell which version of the future will unfold, or when.

Our role isn’t to choose between competing stories. Our job is to build portfolios that benefit when technology delivers, while staying resilient if the path proves slower, bumpier, or more uneven than markets hope.

April Was a Productive Distraction

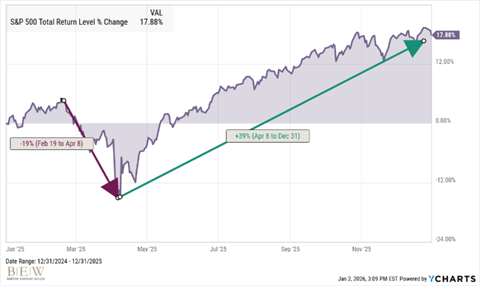

April’s sweeping tariff announcements didn’t just rattle markets, they felt like the start of a new regime.

The narrative crystallized: higher prices, trade declines, renewed inflation pressures, weaker growth, and a Federal Reserve keeping rates higher for longer.

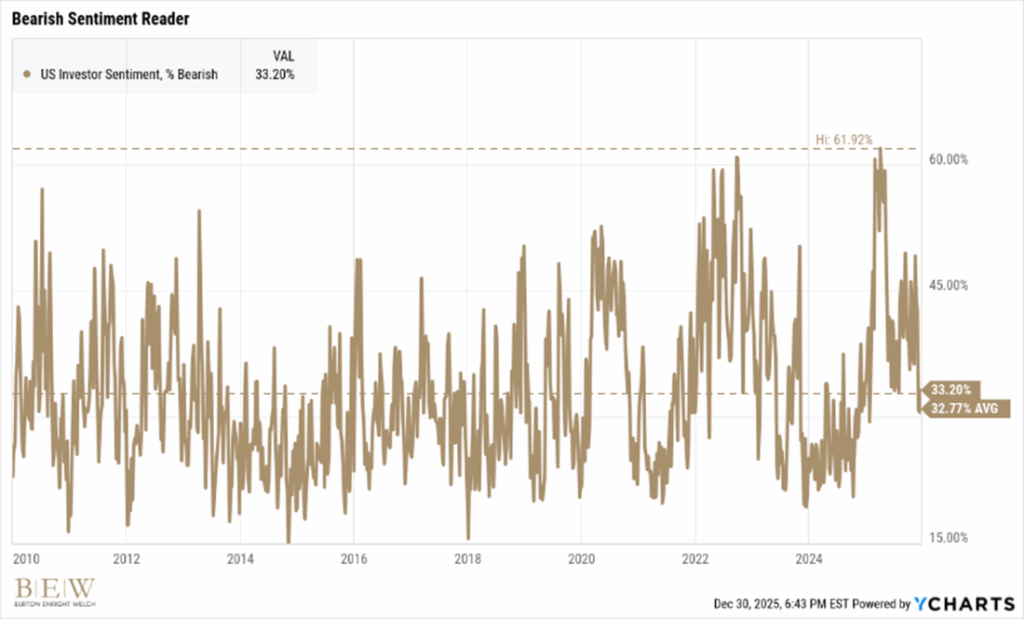

Stocks fell sharply. The S&P 500 suffered its twelfth worst four-day decline since 1950. Bearish sentiment was more prevalent than during Covid or 2022’s bear market.

Perhaps, the market would not take tariffs in stride as it had many past concerns.

And yet, it’s been a one-way trip up and to the right since.

Episodes like this highlight the value of systematic, mechanical discipline. Drawdowns create opportunities to capture tax losses and rebalance portfolios that volatility knocks off course.

We don’t bank on fears easing quickly. But when they do, investors can benefit twice — through the application of discipline during declines and through strong returns as markets recover.

That the stock market rallied despite higher tariffs does not mean tariffs don’t matter. They do. They affect real economies and behaviors.

But the broader lesson echoed something we’ve seen repeatedly this decade:

- Volatility and progress can coexist.

- Short-term fear rarely predicts long-term outcomes.

- Selling into stress has been an expensive habit.

- It’s dangerous to overread any one story in a market shaped by countless narratives.

The April turbulence ultimately became another chapter in a familiar story: unsettling in real time, constructive in hindsight.

Boring Bonds Had a Year Worth Celebrating

While not as dramatic as international stocks, bonds also enjoyed a 2025 redemptive arc.

Between low starting yields and losses due to steeply rising rates post-Covid, many investors lost trust in bonds this decade. The boring, stable part of the portfolio instead supplied losses and volatility.

Many wondered whether bonds would be as effective in the coming inflationary world.

Enter alternatives. Many new strategies have emerged in recent years, claiming to diversify equity risk and address the shortcoming that troubled bonds this decade.

Some of these alternatives have merits and may prove to be worthwhile additions to portfolios. But they come with additional complexity, costs, and limited track records.

So, it was great to see boring, old bonds behave like bonds again:

- Income that outpaces inflation

- Stability when headlines spike

- Appreciation when rates decline

Last year reminded investors that unflashy, undramatic high-quality bonds still play a productive role.

Happy New Year!

It’s important to celebrate years like 2025, when so much went right for investors because we don’t know what performance 2026 will bring, let alone next week or month.

What we do know 2026 will bring: headlines, surprises, and moments that test resolve. Our role remains the same: to help you stay grounded, prepared, and aligned with the long-term goals that matter most.

Thank you for your continued trust. Happy New Year!

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.