On July 4th, President Trump signed the “One Big Beautiful Bill Act” (OBBBA), a sweeping tax package. The law makes permanent many of the provisions of the 2017 Tax Cuts and Jobs Act (TCJA), which were set to expire at the end of 2025. These include lower individual tax rates, a higher standard deduction, and increased estate tax exemption amount, among others.

We’ve highlighted the provisions most likely to impact our clients and their tax planning.

Next week, we plan to write more about the financial planning strategy implications of these provisions. Stay tuned!

Tax Rates Made Permanent: The lower individual income tax brackets introduced by the TCJA—ranging from 10% to 37%—are now permanent.

From a planning perspective, this preserves the opportunity to continue leveraging strategic Roth conversions under current tax rates.

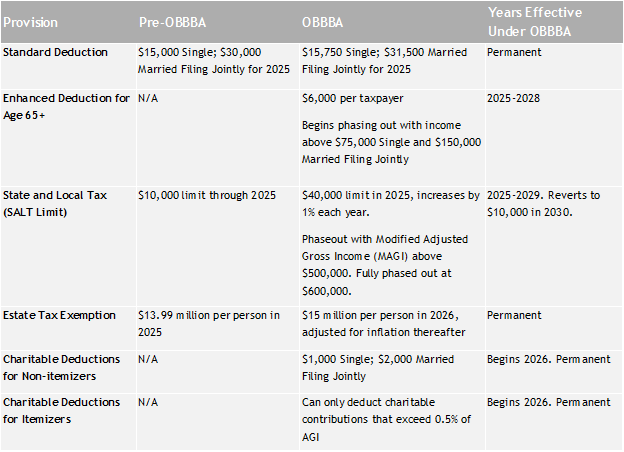

Increased Standard Deduction: The higher standard deduction under the TCJA has also been made permanent. For 2025, it will be $15,750 for single filers and $31,500 for joint filers. Those 65 and older will continue to receive an additional $2,000 (single filers) or $1,600 (joint filers) to their standard deduction.

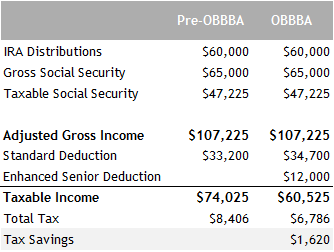

New Deduction for Seniors: Beginning in 2025, taxpayers aged 65+ are eligible for an enhanced $6,000 deduction. However, income limits apply – the deduction starts phasing out with income above $75,000 (single) or $150,000 (married filing jointly) and is fully phased out with income above $175,000 and $250,000, respectively. The enhanced deduction is available through 2028.

Here is an illustration of how the enhanced deduction would work for a married couple with both individuals over 65. This deduction has no direct tie to Social Security benefits.

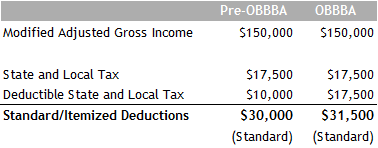

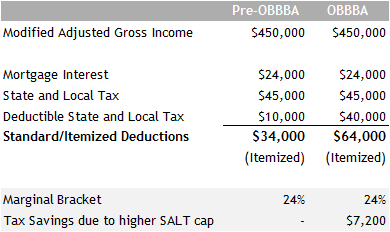

State and Local Tax (SALT) Deduction Limit Increased Temporarily: The TCJA capped the State and Local Tax (SALT) deduction at $10,000. OBBBA increases the SALT limit to $40,000 from 2025 through 2029. The expanded limit phases out for taxpayers with modified adjusted gross income (MAGI) between $500,000 and $600,000. Those with income above the upper phaseout are limited to the previous $10,000 cap.

How much of a tax benefit the higher SALT cap will provide will depend on individual circumstances – MAGI, other itemized deductions (e.g., mortgage interest, charitable contributions), and filing status.

Example: A married couple with $150,000 of MAGI and only $17,500 of state and local taxes to itemize would still end up taking the standard deduction.

Example: A married couple with $450,000 of MAGI, mortgage interest of $24,000 and $45,000 of state and local taxes to itemize would benefit from the higher SALT limit.

Pass-Through Entity Tax (PTET): OBBBA preserves the pass-through entity tax (PTET), a state-level workaround to the SALT limit for eligible business owners.

Itemized Deduction Limitation for High Earners: Starting in 2026, taxpayers in the highest 37% bracket will see a reduction in the value of itemized deductions – limited to a tax benefit of 35 cents per $1 deducted.

Charitable Contributions: Beginning in 2026, those who claim the standard deduction may also deduct up to $1,000 for single and $2,000 for joint filers for cash charitable contributions.

On the other hand, for taxpayers who itemize, the tax benefit of their charitable contributions will be reduced under OBBBA. Beginning in 2026, itemizing taxpayers will only be able to deduct charitable contributions that exceed 0.5% of their adjusted gross income (AGI). For a married couple with AGI of $500,000 and charitable contributions of $5,000, only $2,500 of their donation would be tax deductible.

For the charitably inclined, accelerating charitable gifts into 2025 or bunching contributions with a Donor Advised Fund may be advantageous.

Higher Estate Tax Exemption Made Permanent: The new law increases the estate and gift tax exclusion amount to $15 million for an individual and $30 million for married couples in 2026, indexed for inflation going forward. Without OBBBA, the exemption would have reverted to ~$7 million per person.

Qualified Business Income (QBI) Deduction Made Permanent: For business owners, the 20% Qualified Business Income deduction under Section 199A is now a permanent feature of the tax code.

Increased Child Tax Credit: OBBBA increases the child tax credit to $2,200 per eligible child in 2025, up from $2,000. The same income phaseout thresholds apply ($200,000 for single filers and $400,000 for joint filers).

Increased Dependent Care FSA Limit: Beginning in 2026, the annual contribution limit for Dependent Care FSAs has been increased to $7,500 per family, up from $5,000.

Trump Accounts for Kids: The law establishes a new tax-deferred account for children under 18. Annual contributions are capped at $5,000 and must be invested in a fund tracking a U.S. stock index. Contributions are not tax-deductible.

Withdrawals are allowed after age 18 for any reason, but follow IRA withdrawal rules, meaning ordinary income tax and a 10% early distribution penalty if under 59.5, unless an exception applies.

Additionally, children born between 2025-2028 will receive a $1,000 one-time Federal contribution to these accounts. These accounts are expected to become available in 2026.

As always, we’re here to help you understand how these changes apply to your unique situation and adjust your financial plan accordingly.

Please reach out to your advisor if you’d like to review your tax strategy or discuss planning opportunities.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.