Geopolitics matters, but it’s rarely the force that determines investment results.

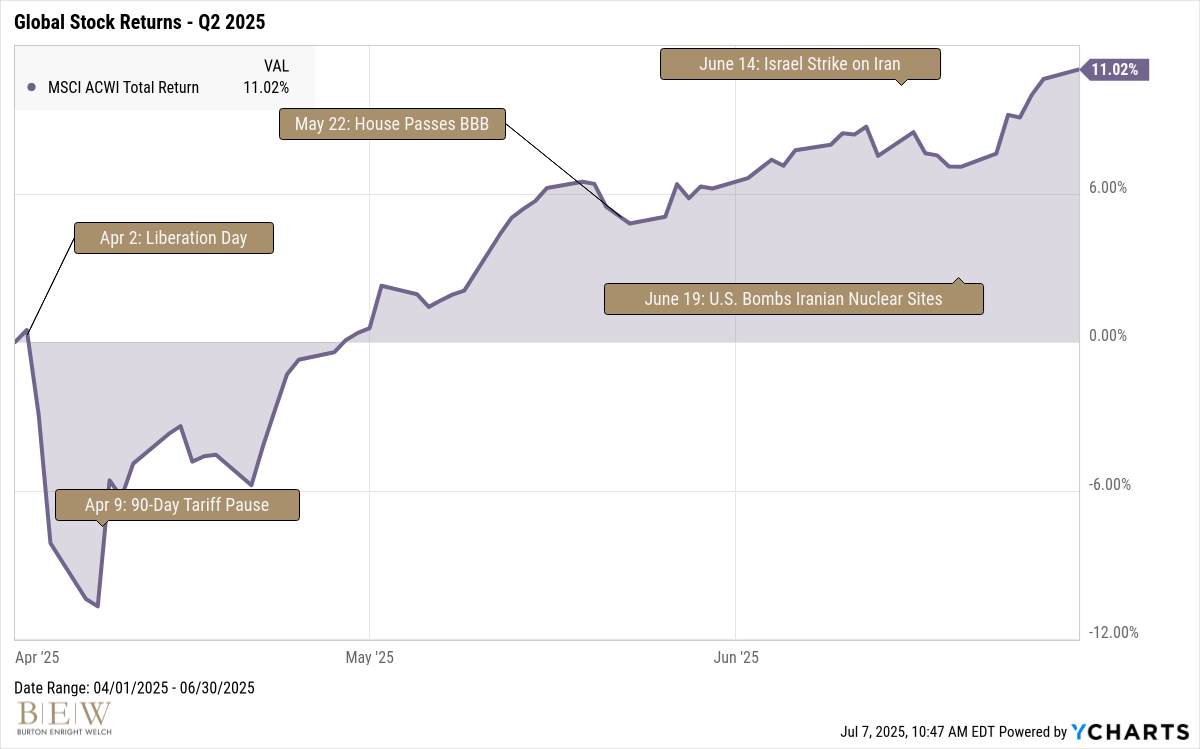

Last quarter put that idea to the test. The relentless pace of global headlines – tariffs, conflict in the Middle East, and debates over U.S. spending – made geopolitics, and predictions about their implications, unavoidable.

Yet, as so often happens, the market’s actual path defied expectations.

A. Short-Lived Tariff Trauma

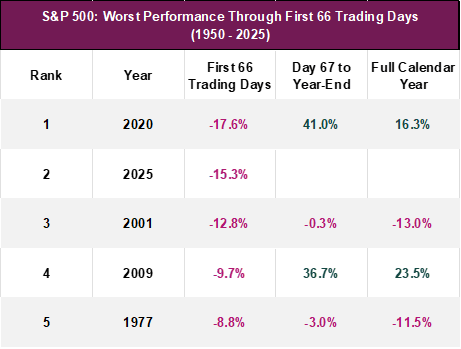

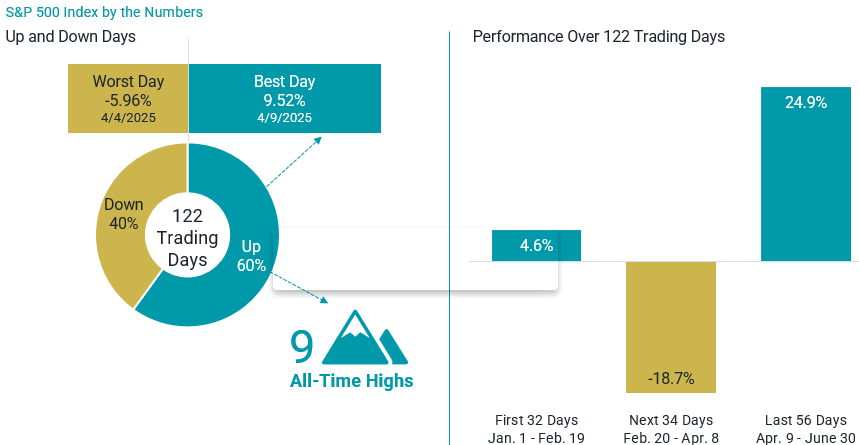

In April, sweeping new tariffs rattled markets. The S&P 500 fell 10% over the two days post-Liberation Day, its steepest two-day drop since 2020.

Sentiment tanked: trade war, resurging inflation, recession, and the Fed holding rates higher. It was a worse start than any year during the Great Financial Crisis or the Dot-Com bust.

But the panic didn’t last. From the April 8 bottom, the S&P 500 surged 25% until quarter-end, establishing a new all-time high.

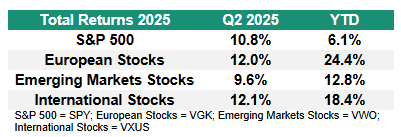

International stocks did even better, continuing their outperformance from Q1.

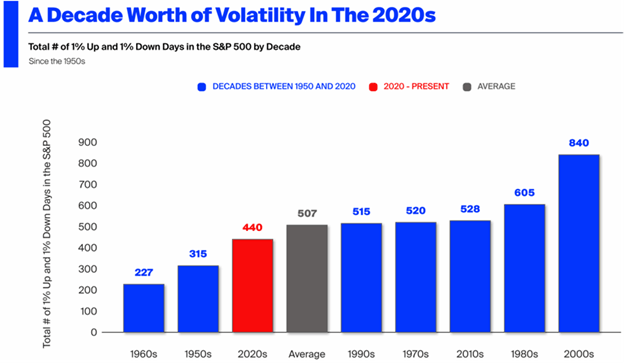

This pattern – sharp drawdowns followed by swift recoveries – has become a defining feature of the 2020s. This decade is on pace to be the most volatile of the last eight.

And with good reason. Recall the parade of upheavals we’ve weathered – the pandemic, 9% inflation, Fed raising rates from 0 to 5%, the banking panic, Liberation Day, etc.

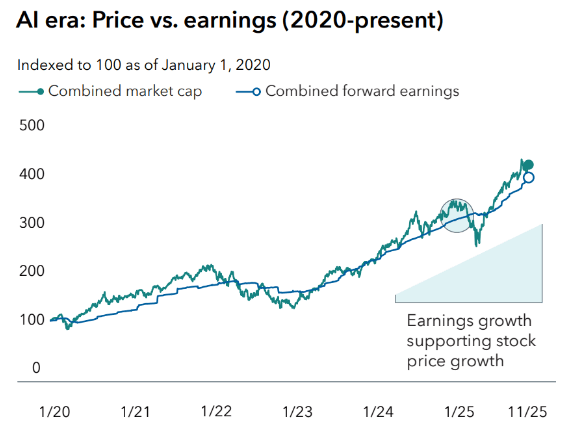

Yet here’s the twist. Investors have prospered. Since 2020, the S&P 500 has gained over 90%, underscoring how resilience and recovery can coexist with volatility.

April’s drop and rebound fit this pattern perfectly – unsettling in the moment, and ultimately another step forward in a decade marked by turbulence and strength.

B. Markets Are Dispassionate

Weeks later, headlines shifted to the Middle East after Israel and the U.S. bombed Iran, raising fears of regional war.

The stock market did not break stride, continuing to climb in the weeks after.

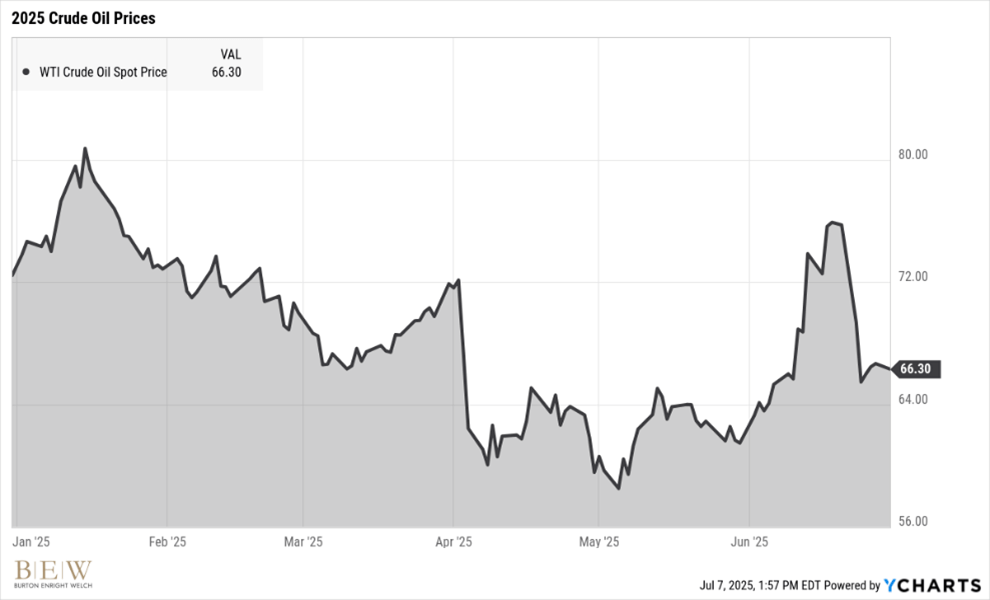

Oil prices also surprised. Historically, conflicts in the Middle East have fueled sharp, sustained oil price increases.

Instead, crude oil prices tumbled 12% in the five days post-US strike and ended the quarter lower than where they started.

Markets weigh countless inputs – geopolitics, economic data, sentiment, etc. This complexity makes it impossible to know how a single factor will ripple through prices.

War is unnerving, and the human and economic stakes can feel enormous. As cold and dispassionate as it sounds, markets often treat such events as background noise unless they disrupt fundamentals.

That detachment often allows them to recover well before the news cycle does.

C. Big Debates, Modest Predictive Power

As the quarter progressed, attention turned closer to home. The Big Beautiful Bill (BBB), signed into law on July 4, reignited familiar debates about U.S. fiscal health.

The projected increase in deficits and the national debt sparked warnings of higher borrowing costs, a weaker dollar, and even the loss of reserve currency status.

Yet bond markets painted a calmer picture. The 10-year Treasury yield barely budged – starting the quarter at 4.23% and ending at 4.24%.

If the market anticipated a debt crisis, we’d expect surging yields on fears of Treasuries oversaturation, higher inflation, and potential credit downgrades.

That’s not to imply the risks aren’t real. Rising deficits are a serious long-term concern and have been for decades (one reason we own international bonds, see next section).

It may be that the market is naïve, that this is a case of “the boy who cried wolf,” and the BBB triggers the long-prophesized comeuppance. Still, the truth is, no one – economists nor policymakers – knows what level of debt tips us into a crisis.

D. A Dramatic and Profitable Quarter

Tariffs, war, and fiscal drama kept investors on edge this quarter, fueling constant speculation about their impact.

In a world full of headlines, markets often remind us of their own logic – one that rarely aligns with the news cycle.

The key is not to overread every disruption. Instead, stay disciplined and focused on what works: trusting time and diversification to quietly do their work.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.