Many of our portfolios have recently added a dedicated international bond fund. It’s a natural extension of one of our core principles: diversification.

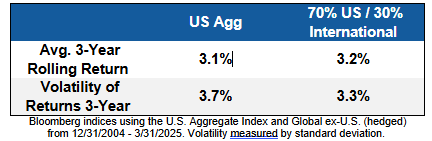

The next chart shows the U.S. bond market (US Agg) versus a blend of U.S. and International bonds over the last 20+ years. Diversification remains the only free lunch in investing – the only way to enhance returns and reduce volatility.

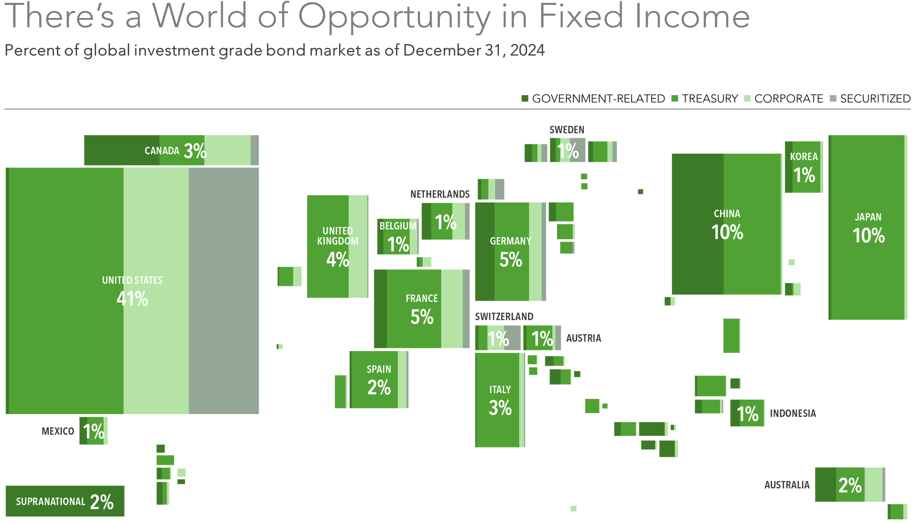

The global bond market (“fixed income” and “bonds” are synonyms here) is enormous, ~$150 trillion. The U.S. represents about 40% of the market. U.S. investors who focus on domestic bonds leave much of the global opportunity set untapped.

Bonds aren’t exciting, and that’s exactly the point. Their role is to bring stability when stock markets are unsettled, generate income, protect against inflation, and preserve capital.

Over long periods, bond fund returns are highly correlated to the starting yield – the income that the bonds promise to deliver if held to maturity.

But in the short term, bonds can present challenges. In 2021 and 2022, sharp interest rate increases caused bond prices to fall. Rates can rise for many reasons – inflation, central bank policy shifts, or economic cycles. When they do, existing bonds decline in value as newly issued bonds offer higher yields.

International bonds diversify against this country-specific risk. Interest rates, inflation, and economic conditions vary across countries, so international bond returns don’t always move in lockstep with U.S. bonds. By combining U.S. and international bonds, portfolios have experienced a smoother ride.

While a few of our existing fixed income funds include international bonds, we decided to add a dedicated position. Doing so enhances our ability to rebalance, manage cash flows, and capture opportunities in global bonds.

The Vanguard Total International Bond ETF (BNDX) invests predominantly in investment grade bonds issued by foreign governments with maturities up to ten years. Its portfolio spans more than three dozen countries, with the largest allocations in Japan, France, Germany, Italy, and the United Kingdom. Importantly, BNDX hedges its currency exposure, which reduces the impact of foreign exchange fluctuations on returns.

As always, our focus remains on building portfolios designed to weather uncertainty and deliver steady, long-term progress toward your financial goals.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.