Key Points

- Our portfolios have minimal exposure to Russian stocks.

- The Russian stock market crash is another powerful lesson that investors must diversify.

- Unfortunately, war is a not uncommon challenge for investors. Investors should expect unexpected crises on their path to long-term returns.

When a crisis occurs, like with Covid-19 or now the war in Ukraine, it’s natural for fear to influence portfolio decision-making. We’ve found that collecting perspectives is the best fortification.

Here, we’ll share perspectives that help us consider the current moment.

Russia Stocks in Our Portfolios

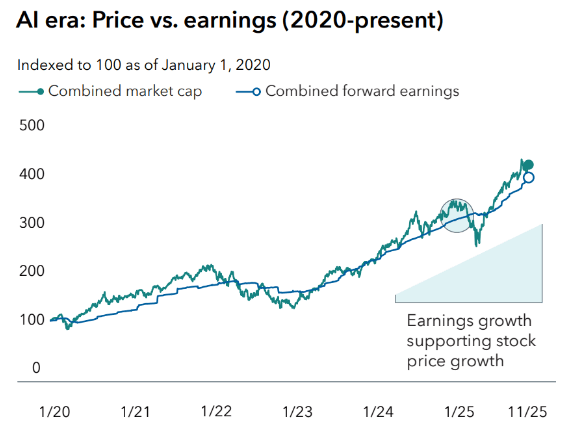

The most immediate and dramatic financial impact the conflict has had is on the Russian stock market. The chart below shows the decline in value of Russian stocks and of the Russian ruble.

How does a stock market decline by 81% in ten days? First, it falls by 56% in seven days. Then, it falls another 56% the next three days.

Pre-crisis, Russia’s stock market was about 1/3 of 1% of the global stock market. Russian stocks were an even smaller share of our stock portfolios. Most clients have sizable bond allocations. So, in sum, our clients have very little direct Russian stock ownership. Moreover, Russian stocks will disappear from portfolios in the coming months as U.S. funds divest Russian holdings.

Moving forward, there will be second (i.e. companies with Russian and Ukrainian interests) and third-order (i.e. effects from new security, energy, financial, and trade policy) impacts.

We trust our asset management partners to evaluate these changes, identify risks and opportunities, adjust portfolios, and communicate with us. Our Tuesday webinar with Oakmark (register here) will discuss this topic further.

Another Diversification Lesson

Pictures have circulated of long lines at Russian ATMs and crowds at a soon-to-close Russian Ikea. It’s hard not to feel sorry for ordinary Russians.

The chart below illustrates another dimension of suffering. It shows what proportion of portfolios in each country are invested in domestic stocks.

All investors tend to overweight investments in their home country. The U.S. stock market is just over half of the global market, and U.S. investors keep three-quarters of their stock exposure at home. Pre-war, 95% (!!!) of Russians’ portfolios were Russian stocks, despite what a tiny blip the Russian stock market is of the global opportunity set.

The Ukraine invasion demonstrates that the world can turn ugly – dramatically and unexpectedly. Diversification is the best protection against what is unthinkable today.

Historical Perspective

We’re reluctant to make a World War II analogy. But the story here is too interesting and instructive.

The following chart shows the Dow Jones Index from 1939 through 1945. At the market bottom in April 1942, the U.S. had been at war for four months. Germany and Japan were dominant. The U.S. and its allies were suffering notable defeats.

From that bleak moment, the market rose despite the war continuing until 1945. How can it be a good time to invest when everything seems terrible? War can be very confusing for investors.

Finally, as sad as it sounds, war is a not uncommon challenge that long-term investors must endure. These unexpected challenges may set portfolios back for a time. But by remaining disciplined, investors have enjoyed tremendous growth.

Beyond its tragic human costs, Russia’s invasion of Ukraine has disrupted markets and alarmed investors. Like everyone, we hope for an imminent resolution to the conflict.

We will continue to monitor the fast-moving situation and its potential impact to our strategies. We will act and communicate as developments warrant.

Burton Enright Welch is an independent, fee-only financial planning and investment management firm based out of Walnut Creek, California.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.