This has been an overall rotten year for investors. The last couple weeks have been especially rough. The S&P 500 is in the midst of its third double-digit decline this year and just closed at a 2022 low.

Recent weeks’ headlines have turned uneasiness into anxiety. Inflation is at 40-year highs. Interest rates are rising at their fastest pace in history. Federal Reserve (Fed) officials state that a recession, higher unemployment, and a hit to the housing and stock markets may be necessary to suppress inflation.

It’s no surprise that pessimism abounds.

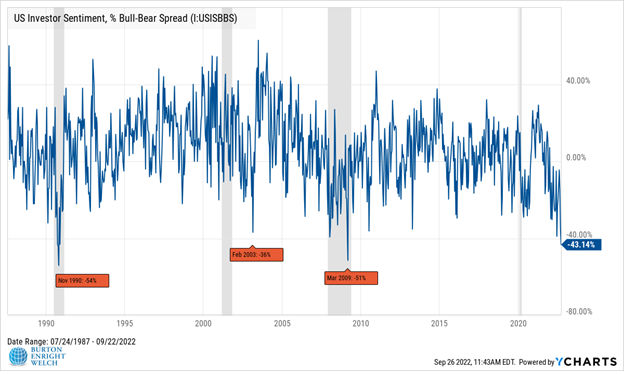

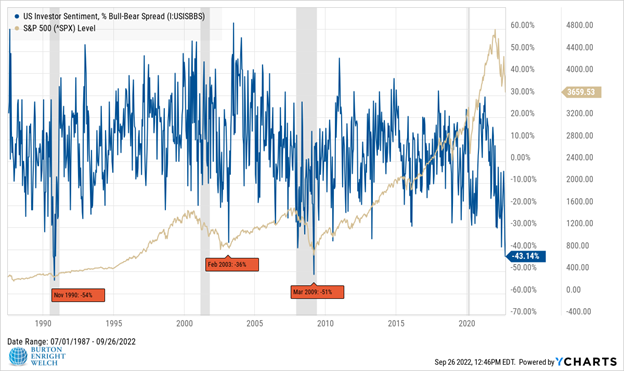

The American Association of Individual Investors regularly surveys investors. Last week was the third most bearish sentiment over 35 years.

Despite current challenges, the above chart suggests reason for optimism. When sentiment has been this poor, some of the largest and longest bull markets in history followed.

That is no mere coincidence. What seems like justifiable pessimism in the short-term has typically been a great long-term buying opportunity.

Today, as long as inflation remains high, investors worry that Fed actions will be unfriendly to stock prices. As no one – economists and Fed officials included – knows when inflation will subside, that anxiety is understandable.

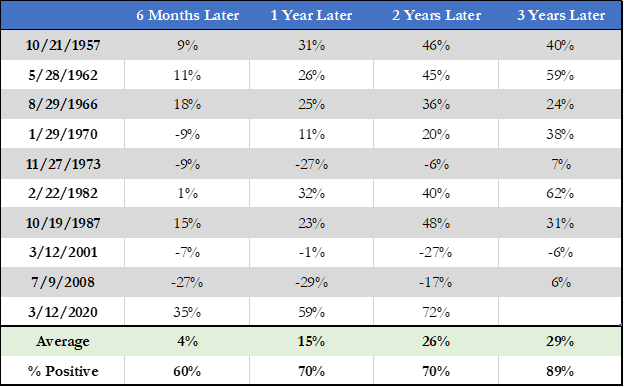

However, the long-term picture looks more promising. Here are S&P 500 returns after falling 20% from record highs.

Stocks are on sale right now. We can have interesting and lively discussions about whether there will be further discounts and how long the sale will last. Pessimists may in fact look wise in the coming weeks and months.

Yet, the known known is that we haven’t seen today’s prices since 2020. Those who can buy now will receive a discount. Those who avoid selling should feel optimistic about future returns.

The paradox and opportunity of investing is that the best times to invest are when people feel the worst. As counter intuitive as it may seem, this may be one of those times.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.