The S&P 500 is up 12% this year, cash is paying 5%, and inflation has retreated under 4%. Investors must be feeling pretty good, right?

No, the mood seems glum, especially after a choppy third quarter. Perhaps, it’s the aftermath of a dismal 2022. Or constant speculation about an impending recession. Or the daily reminders of inflation.

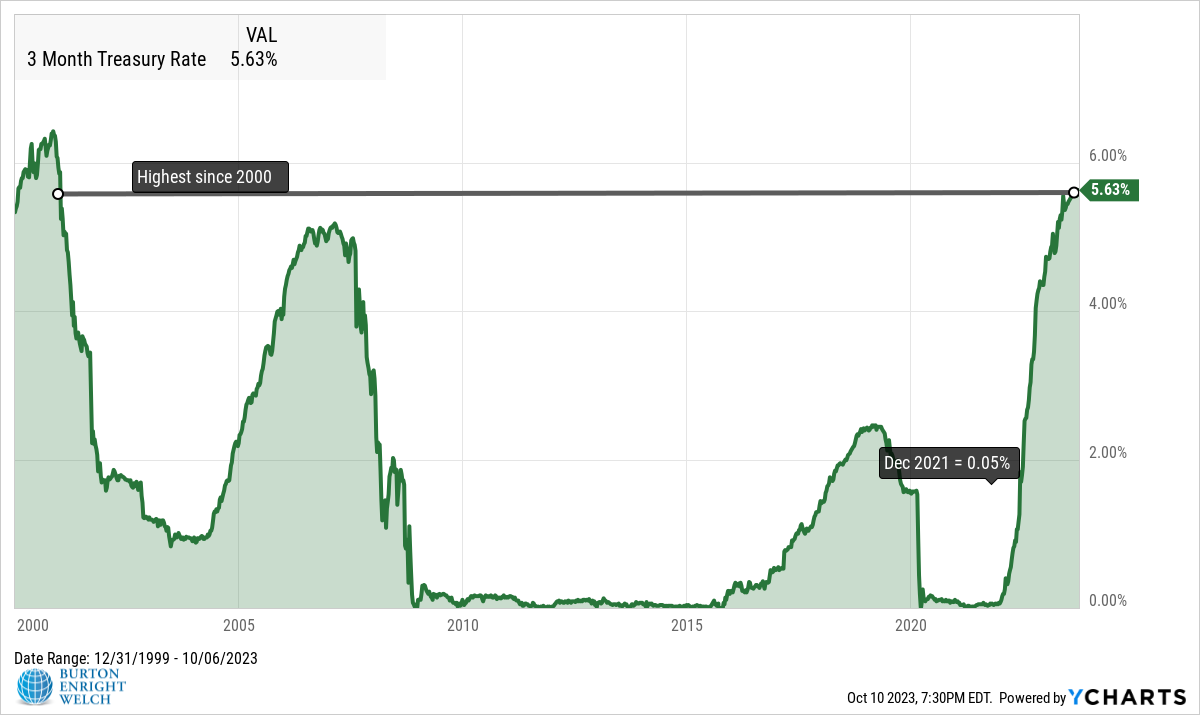

Pessimism paired with the highest cash yields in decades has prompted many to ask why not “T-Bill[1] and Chill” – i.e., collect 5% in cash or Treasuries and wait for warmer investing waters.

[1] T-Bill = U.S. Treasury bonds with a maturity of one year or less

And in fact, that’s what many are doing. U.S. money market funds have received almost a trillion dollars in inflows since 2022.

Despite the juicy risk-free opportunity, the adage, as always, holds – there are no free lunches in investing.

Investors should consider the following before loading up on cash:

- Their time horizon

- Thou shalt not market time

- Reinvestment risk

Match Assets to Time Horizons (MATH)

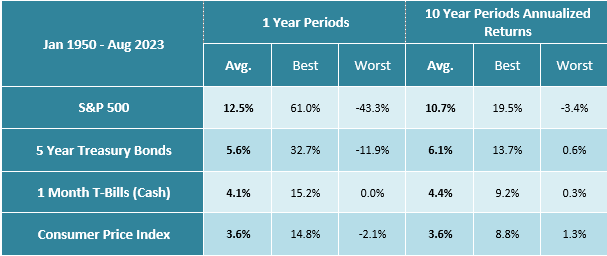

Inflation’s reemergence underscores one of the primary purposes of investing – to overcome diminishing purchasing power over time.

Cash is great for solving short-term spending needs, i.e., 2023 and 2024. When it’s time to pay, there is no uncertainty about what your dollars will be worth.

Conversely, stocks are poor at solving short-term spending needs – when you want to turn stocks into cash, $1 may have become 90 cents or less.

Against long-term inflation, the story reverses. Cash turns unreliable, and stocks become reliable. Why?

Nearly all of lifetime spending will be years or decades in the future. On that horizon, stocks and long-term bonds are much likelier to preserve purchasing power. Ironically, cash is the less certain asset.

Do not conflate the certainty of cash today with its reliability in the future.

Beware Market Timing

Most investors recognize the perils of selling stocks to sit in cash. You have to time two correct decisions – when to sell and when to buy back.

However, many of the same investors build cash reserves far beyond short-term spending needs. This is especially true when cash sports a juicy yield and markets are tumultuous.

This is also market timing. Without a plan to invest, feelings dictate, and savers are vulnerable to the market’s psychological tricks.

Market declines validate the decision to remain in cash and breed overconfidence (“I knew the market would go down.”).

Instead of capitalizing on the decline, the saver will cite the accompanying bad news and continue waiting (“I think the market will go down more.”).

Likely, the courage to buy won’t come until the market rallies and greed overcomes fear (“I don’t want to be left behind.”).

Of course, these impulses violate investing’s cardinal rule – buy low.

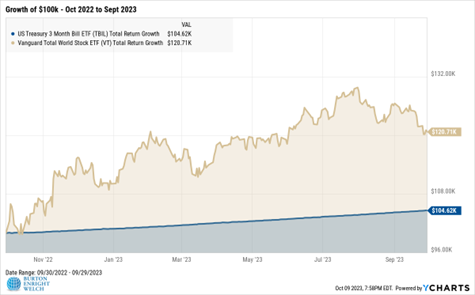

They also assume that an all-clear bell will signal the time to buy. Yet, the market tends to rise well before pessimism flips to optimism. Case in point, September 2022 was bleak, with steep declines and rampant pessimism. Those who stuck to cash missed a subsequent 20% stock market rise.

Our advice here is simple – make a plan and stick with it … no matter what.

For example, dollar cost average cash into the market – split purchases over multiple months. Pre-program how much to invest and exactly when. Don’t waver. Dollar cost averaging reduces the potential of bad timing and doesn’t allow emotions to take the steering wheel.

Let us know if you want help building a plan.

Reinvestment Risk

Short-term rates are fickle – they can decline as quickly as they shoot up. When a T-Bill or CD matures, yields may be much less attractive.

We can never take the Fed’s rate forecasts too seriously (see the gentle rate increases the Fed projected in 2021 for 2022-23.) Still, they remain a useful guide. Today, the Fed projects just one more potential increase in November, followed by decreases over the coming years.

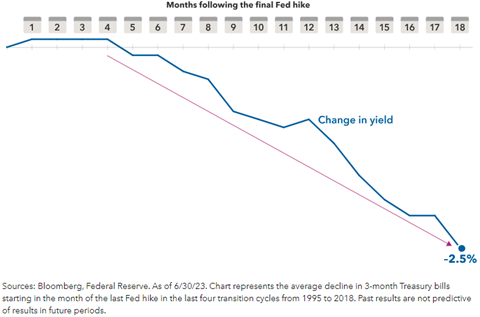

Historically, cash yields have declined quickly following the final rate rise.

When it’s time to reinvest, not only may another CD or T-Bill have lost appeal, a saver may have also missed a great opportunity in stocks and bonds.

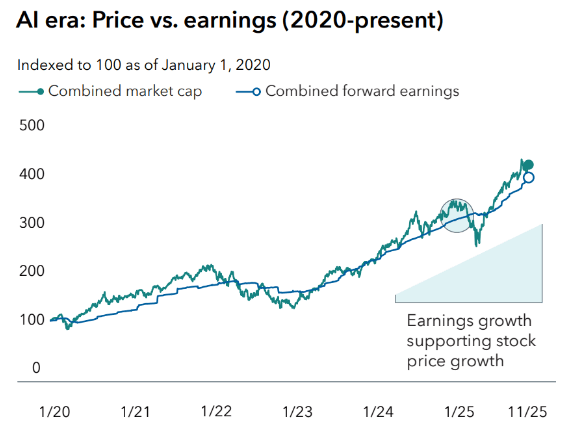

After the previous four Fed rate hike cycles, stock and bond returns[1] have been strong, particularly in the first year.

[1] Bloomberg U.S. Aggregate Index

Make an Investment Plan

Today’s attractive cash options are worth pursuing. If you have money sitting in a bank account earning nothing, consider moving to a CD, high-yield savings account, money market fund, or T-Bill.

Still, if cash exceeds your short-term needs, then implement a plan to invest. While “T-Bill and Chill” may be appealing, markets change fast. Over the long-term, investing has been the safer option.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.