Owning stocks can be emotionally punishing.

We preach maintaining a long-term mindset and embracing volatility in the short-term. But it is still sobering to see clients’ accounts drop, even if it is just pixels on a computer screen.

Still, we want to emphasize how necessary it is to maintain perspective on current events. There are always headlines that portend danger (Financial Crisis, COVID, Ukraine).

Here are brief definitions of terms that the media has been generously using:

- Correction – a drop of 10% from the market’s peak

- Bear Market – a drop of 20% from the market’s peak

- Recession – two consecutive quarters of negative GDP growth. A Recession describes the economy and not the stock market, though the two are often correlated.

- Negative Interest Rates – Central Banks in Europe and Japan are trying to force banks to lend money to rev up the economies. With negative rates, instead of earning interest, banks pay to hold cash. After one year, $100 turns into $99.80. Strange times.

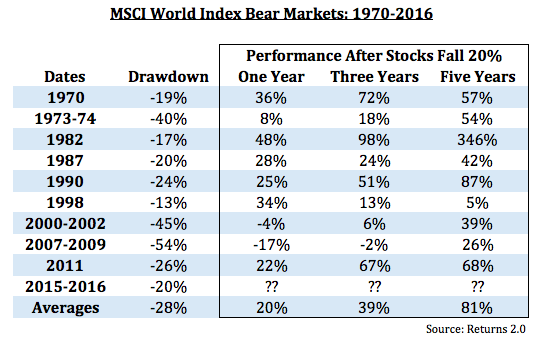

The biggest risk for investors is that they overreact to bad news. By focusing on bad news, an investor risks exiting the market and not participating in the longer-term rewards (see below).

Pretty amazing to see how shallow-looking famous bear markets were when you zoom out to a long-term perspective.

Stock markets are always going to fluctuate unpredictably in the short-term. By nature, stocks go down, often, and sometimes by a lot.

As advisers, our job isn’t to shield clients entirely from these downturns. Trying to do so would be disingenuous and very counter-productive. Our job is to coach you through rough patches and ensure that you remain long-term investors. Like many things in life, in investing the reward is proportionate to the pain.

So, What Should You Do?

Advising clients during the Great Recession demonstrated what a powerful call-to-action pessimism is. Pessimism demands action – “Sell! Get out now!” In comparison, optimism – “Stay the Course” – sounds weak and oblivious to risks.

Nobel Prize-winning psychologist Daniel Kahneman wrote that “Organisms that treat threats as more urgent than opportunities have a better chance to survive and reproduce.” The human that reacts like the rustling bush is a lion will survive even if it’s just the wind.

While pessimism aids survival on the savannah, it is harmful for investors. It flies in the face of decades of evidence that the markets reward patiently (and anxiously) remaining invested during downturns.

Great, but is there really nothing I should do?

We have guided clients through many rough markets over the last 25 years. Here are three suggestions:

- If you do not have a financial plan, ask us for one. And if you have one, let’s revisit it. We’ve found that doing a financial plan does wonders for peace of mind and discipline during tough market stretches. For example, a financial plan can illustrate the impact of an extreme Bear Market on your portfolio and future spending.

- If you are planning an elective distribution in the near future, contact your adviser. We want to avoid selling distressed assets and locking in losses. Our clients with anticipated distributions have large allocations to fixed income. These assets have remained relatively steady despite the stock market turbulence.

- If you have money on the sidelines, now is the time to invest! And if you are contributing to a retirement plan, consider adding more. We do not know if this is the bottom. But we do know that you would be investing at a nice discount to prices of a year ago. Your best investments will likely be in times like this. See chart below.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.