In many ways, 2019 was a fitting end to the 2010s. Many decade-long themes continued: U.S. and tech stock outperformance, gains amid geopolitical tumult, and scrutiny over Federal Reserve policy.

Another parallel was the preceding environment. December 2018 was the U.S. stock market’s worst December ever. The 2000s included two bear markets and posted the S&P 500’s lowest decade return (yes, worse even than the 1930s Great Depression).

The 2010s owe much of their robust returns to timing. The Great Recession dug a deep hole. Not until 2013 did the U.S. market climb back to its 2007 high.

The Great Recession also influenced the 2010s in ways beyond the numbers. “But who knows when the next downturn happens” is still the undercurrent of many conversations about the markets. The specter of a steep selloff arriving seemingly out of nowhere is not far from people’s minds.

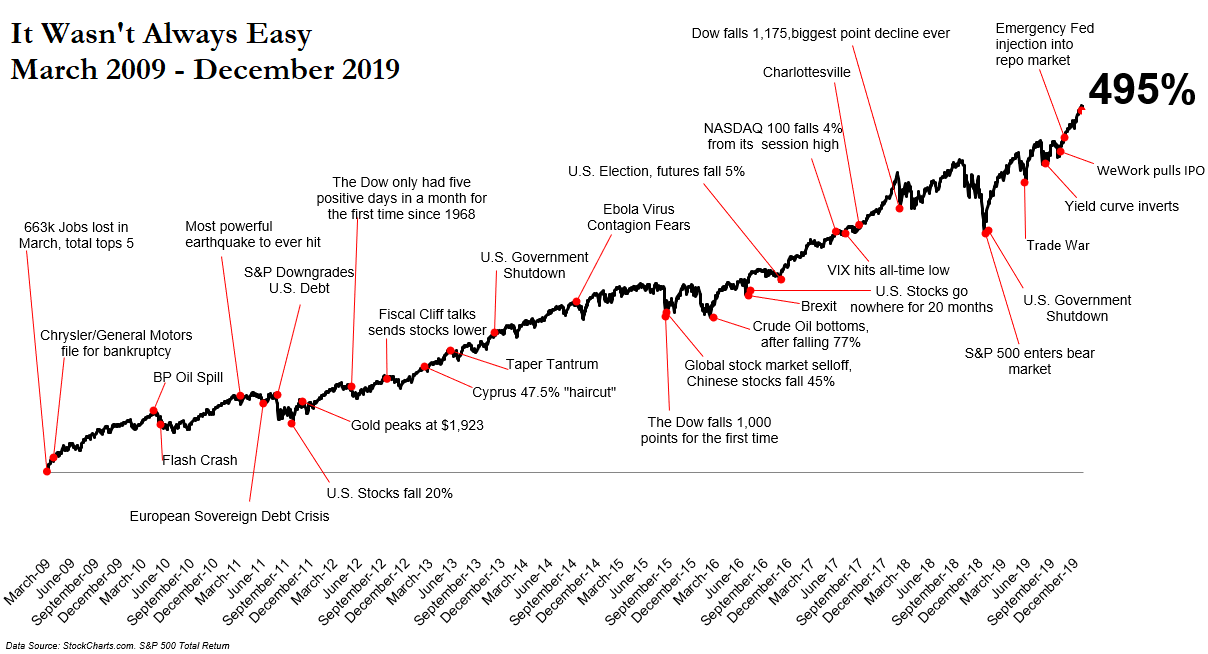

To some extent, gloom may be healthy. There are few signs of the widespread exuberance that a long bull market typically generates. On the other hand, this has been the least loved bull market in memory. Investors spent the decade looking for the next recession around every headline (see below).

When the next downturn does arrive, investors will be tempted to draw a direct line from the news to the markets. Recognize that the 2010s offered ample events that would have been held responsible for a concurrent recession. As 2020 is a presidential election year, it’ll be especially important to not read too much headline drama into the markets.

We never have forecasts for new years. We won’t start for new decades. The closest we’ll come is to point out just how dissimilar the 2000s and 2010s were. What follows are charts that tell the story of the last ten years. The 2020s are unlikely to look similar.

A Strong Decade for U.S. Stocks

Today’s most oft-cited index for U.S. stocks – the S&P 500 – followed its worst decade with one of its best. The index delivered double-digit returns in seven of ten years. The 1980s and 1990s were the only other decades that had just one year of negative returns.

Despite the bull market passing ten years in length, 2019 narrowly missed producing the decade’s highest return. During December 2018’s turmoil, we do not remember anyone’s 2019 prediction resembling this result.

A Strong Decade, a Middling Century

Beyond strong returns, the 2010s also featured historically low inflation. The S&P 500’s real return (total return minus inflation) was well in excess of its long-term average. Investors could not have asked for more.

Still, the 2010s have not made up for the century’s slow start. The 21st century has produced just a 4% real return, much lower than the 6% real returns U.S. stocks have generated over multi-decade time horizons.

The century’s thus far lackluster returns owe much to the timing of the 2000 tech bubble. Cycles have driven the 21st century much like they have all of market history. As such, it’s important to remember that periods of outsized returns eventually give way to periods of lower returns.

The Rise of Big Tech

Perhaps no story better represents the decade – in the markets and otherwise – than the rise of Big Tech. At decade’s start, Facebook was not a publicly-traded stock, and Apple, Microsoft, Amazon, and Google had a combined value of $718 billion.

By decade’s end, the five companies were worth $4.7 trillion, more than every country’s stock market except the U.S., China, and Japan. In 2019 alone, Apple’s value increased by over half a trillion dollars! With Apple, Google, and Facebook all headquartered in the Bay Area, it’s hard to fathom the impact on the local economy.

From today’s vantage, a world where the five tech juggernauts aren’t dominant is difficult to imagine. Yet, according to market history at least a few of these behemoths are likely to fall in next decade’s charts.

Not Everything Did Well

In a decade driven by the rise of digital technology, it seems fitting that the value of raw goods suffered.

Among the decade’s worst-performing mainstream investments were gold, energy stocks, and commodities. Gold and energy stocks returned about 3% annualized over the decade, worse than U.S. bonds and with much more volatility. An investment in the Bloomberg Commodity Index would have lost half its value over ten years.

Of course, the reverse was the case in the 2000s. Tech stocks had a dismal decade while gold, energy, and commodities were rare bright spots despite two recessions.

The Negative Interest Rate Saga

For economists, the decade’s most important phenomenon was negative interest rates. When the decade started there was no such thing. Today, there is $13 trillion of negative yielding debt, down from a peak of $17 trillion.

Previously, in economics textbooks, negative interest rates were a theoretical impossibility. Central to Economics 101 is that investors demand a positive return in exchange for their capital.

With negative interest rates, investors willingly pay for the right to lend money! For a 10-year Swiss bond paying -0.59%, an investor hands the Swiss government $10,000. Ten years later, the government repays the investor with $9,425. To reiterate, the investor does this willingly and with perfect foresight.

Negative interest rates speak to a broader story this decade of central bank intervention. Negative rates are a controversial experiment by central banks to stimulate lagging economies. Their idea is that investors will eschew negative rates and put their money to work in the economy. The verdict on the efficacy of negative rates is likely many years away.

Looking Ahead to the 2020s

Negative rates are an extreme example on the limits of established wisdom. The next decade is likely to bring many surprises, perhaps even some that will disrupt strategies that seemed failproof in the 2010s.

For these reasons and more, it’s important to remain diversified. Diversified portfolios may feel lacking when U.S. and tech stocks are ascendant. Yet, our job is to ensure clients recognize the cyclical nature of investing and that their portfolios reflect that reality.

Whatever the future holds, we look forward to what the ever-changing, never-boring, theoretical-impossibility-defying world brings in the 2020s. We’re excited to accompany you on the journey.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.