Tariffs, Tech, and Tailwinds: A 2025 Market Midyear Check-In

We were pleased to host Mila Jankova, Investment Director at Capital Group, for a wide-ranging discussion on the markets, international investing, and global innovation. Here are the key themes from our conversation:

Tariffs Are Back in Focus

- Management teams are bracing for volatility but showing resilience.

- Some firms, like Inditex (Zara), are positioned well thanks to proximity sourcing.

- Companies have quietly restructured supply chains since the first Trump term.

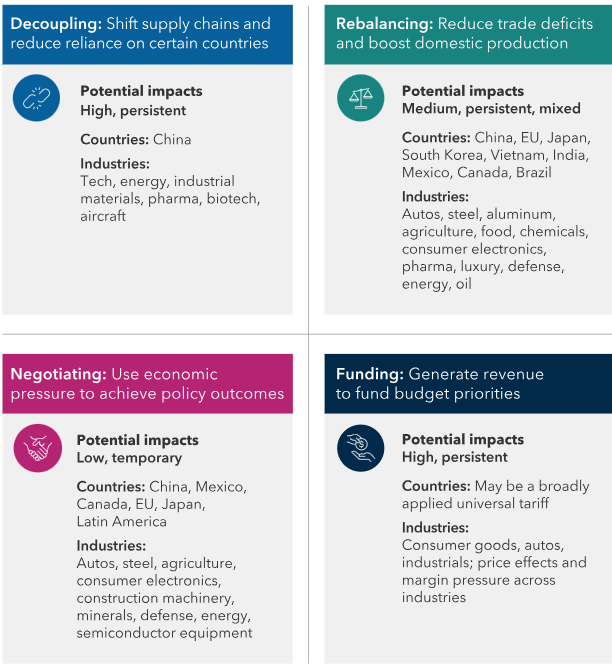

- Capital Group uses four lenses to understand tariffs’ motivations and potential impacts: Funding, Decoupling, Rebalancing, Negotiating.

European Business Sentiment May Be Turning

- Germany has shifted from fiscal austerity and lifted defense spending caps.

- A shift toward more business-friendly regulation and fiscal expansion could boost growth.

- European equities still trade at much lower valuations than U.S. stocks.

International Stocks Are Having a Moment

- YTD, non-U.S. markets are far outpacing the S&P 500.

- Valuations outside the U.S. remain attractive.

- Global markets are broadening, with sectors like industrials and energy equipment poised to benefit.

AI as a Global Megatrend

- U.S. tech leads (NVIDIA, Broadcom). But global supply chains (e.g., TSMC) are critical players.

- Europe and China are innovating too — from DeepSeek to Ray-Ban’s AI-enhanced smart glasses.

- Healthcare may see major gains from AI in drug design and trial efficiency.

- Investors tend to overestimate the impact of technological shifts in the near term and underestimate the long-term impact.

- PC and Internet penetration is far beyond what most people expected at the dawn of those technologies.

Currency

- A weakening dollar has boosted international returns for U.S. investors.

- Capital Group considers currency risk mostly at the company level — where goods are made and revenue earned.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.