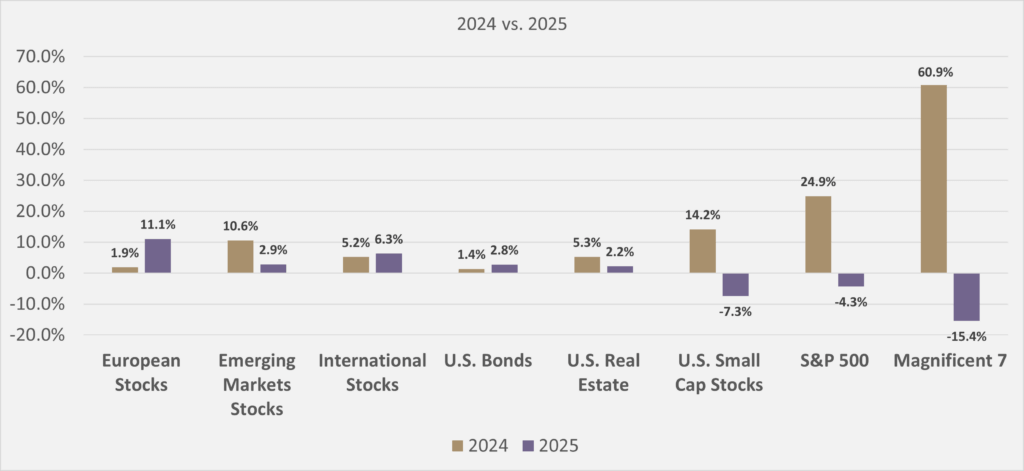

2024 & 2025 Asset Class Returns through March 31, 2025

Last quarter, we made the case for diversification – an age-old principle that has improved returns and reduced risk across nearly every period in market history.

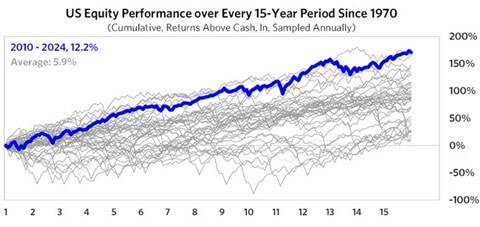

Yet in recent years, diversification has often felt out-of-touch, even antiquated. That’s what happens when one asset class – U.S. large-cap stocks – dominates so thoroughly. We have just lived through the strongest fifteen-year stretch for U.S. stocks since 1970.

It’s only natural: when a trend is this powerful and persistent, investors lose interest in anything else. And understandably so – fifteen years is a long time!

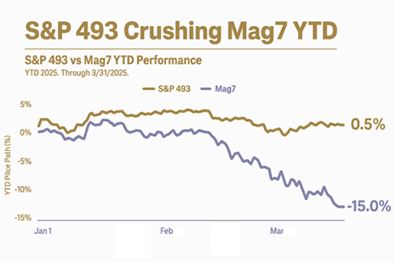

1. Mag7

Recency bias has been even more potent with the market’s most prominent tech stocks, a.k.a. the Magnificent 7 or “Mag7” – Apple, Amazon, Google, Meta, Microsoft, Nvidia, and Tesla.

At their peak, the Mag7 represented 35% of the S&P 500, an extraordinary level of concentration. In 2024 alone, they added $5.3 trillion in value, accounting for more than half of the index’s gains. The S&P 500 became less of a broad-market index and more a barometer of seven companies.

But in 2025, the tide has turned. Apart from Meta, every Mag7 stock is down double-digits. Instead of propelling the market higher, they have become a drag.

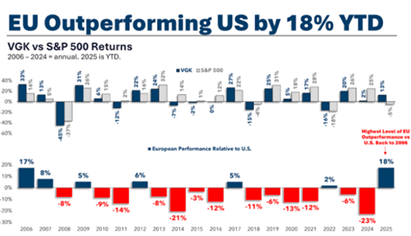

2. Europe Off the Mat

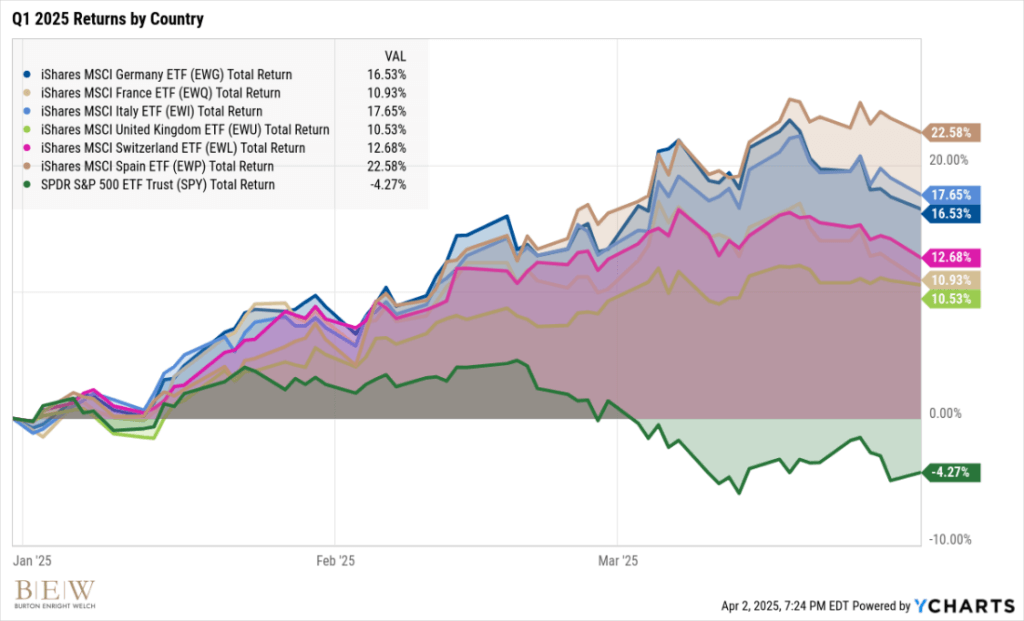

Meanwhile, European stocks have (finally) come to life. After fifteen years of underperformance – marked by debt crises, Brexit, fiscal austerity, regulatory headwinds, negative interest rates, and war – investors considered Europe over-the-hill, a market backwater.

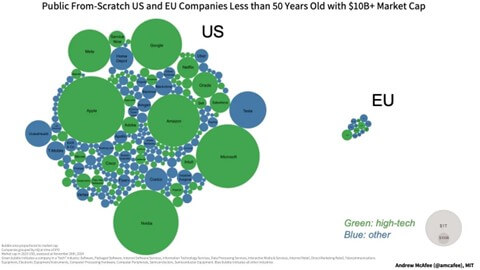

With no major tech sector, weak demographics, and a poor track record of company creation (see below), the region lacked an obvious growth story. Low valuations alone aren’t enough to catalyze a market revival.

Then, geopolitical tension caused unexpected second-order effects. The threat of reduced U.S. military support spurred European governments to announce a wave of fiscal spending – an unusual move in a region long associated with budget restraint.

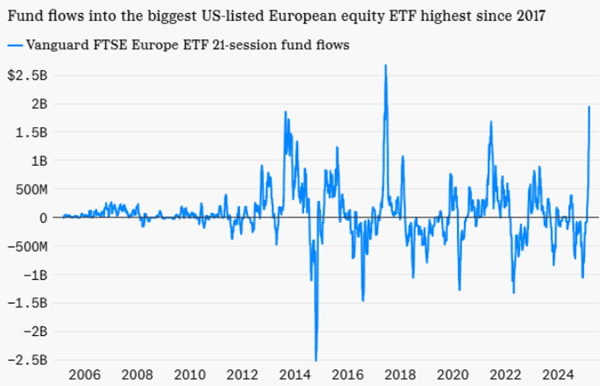

Suddenly, investors started paying attention. Billions have flowed into European markets as sentiment and outlook have started to shift.

It is a reminder that in markets, change often doesn’t announce itself in advance. No one – and we mean no one – had this in their 2025 predictions.

3. Value > Growth

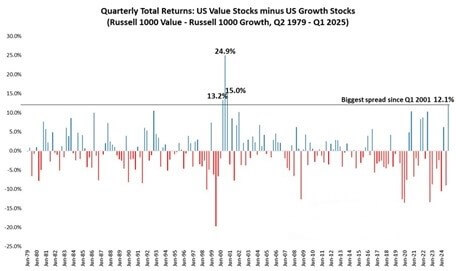

Similar to U.S. vs. Europe, growth stocks have outperformed value stocks for the better part of the last fifteen years.

Growth stocks, like the Mag7, are companies that investors expect to generate rapid earnings growth well into the future. Investors are therefore willing to pay higher prices for these companies.

Value stocks, by contrast, tend to be more mature businesses with less expected future growth and correspondingly lower stock prices.

We’ve seen short bursts of value leadership – 2016 and 2022. The longer trend has been persistent growth outperformance leading many to question whether value investing still works.

But just like geographic leadership, style leadership rotates, often unexpectedly. What underperforms for years can reassert itself.

Last quarter, value stocks outperformed growth by the widest margin since Q1 2001.

This quarter’s reversal doesn’t guarantee anything moving forward. But it does reinforce why we don’t abandon long-term disciplines, even during long stretches when they feel out of step.

4. The Case for Diversification, Reaffirmed

This quarter’s value and European stock performance is a timely reminder: the benefits of diversification often arrive when least expected.

Investing in Europe and in value stocks – or really anything not in U.S. tech – has felt like betting against the winners. Diversification is a recognition that winners change.

Which is exactly the point. Diversification isn’t about predicting what will outperform next. It’s about accepting what we don’t – and can’t – know, and positioning portfolios to benefit when fortunes shift, as they inevitably do.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.