As we wrote last month, we’d prefer not to address politics, but we are undeniably in a political moment.

That was hammered home this week with President Trump’s latest tariff announcement and the ensuing stock market tumble.

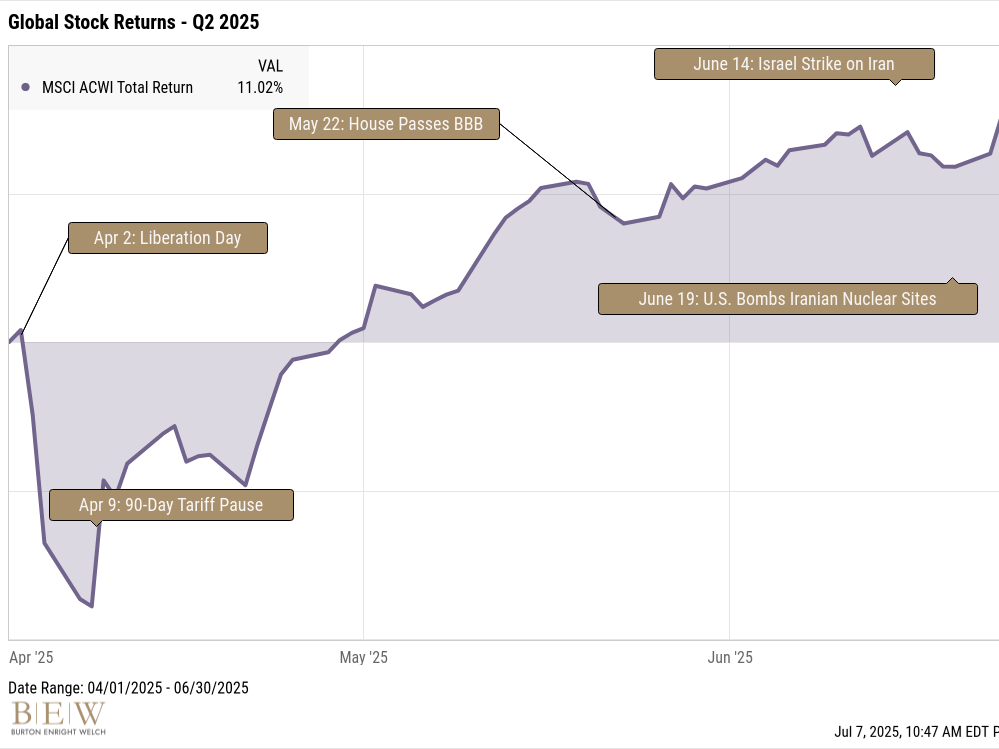

For weeks, tariff drama has dominated headlines. Each rumor or announcement jolts markets and investor nerves.

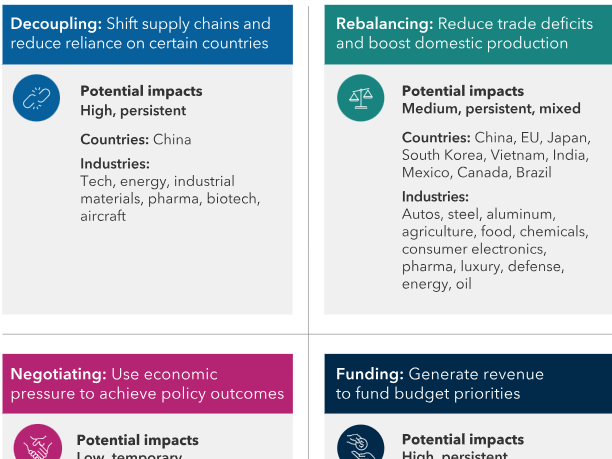

We recognize the impulse to make changes. We are considering potential impacts and whether they warrant portfolio adjustments.

But let’s be upfront: we are in a storm right now. The current environment is destabilizing and disorienting. In times like these, it’s crucial to acknowledge our limitations – we must discount our ability to make sound, long-term decisions in real time.

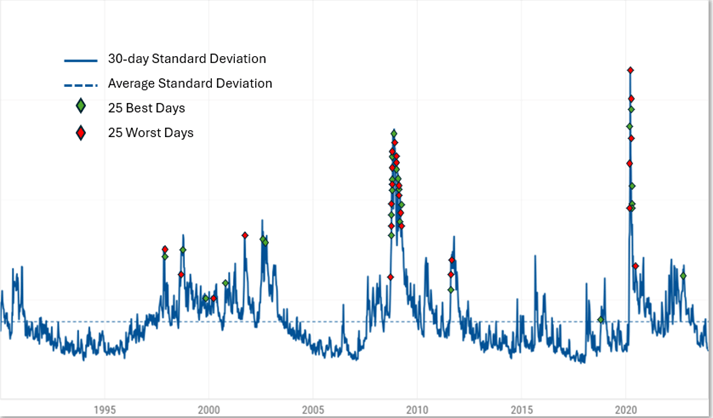

The next chart highlights market volatility – the sharp spikes are the Great Financial Crisis and the onset of Covid – events we all remember for their worst days.

What’s often overlooked, however, is that many of the market’s best days also occur during crises. Reacting hastily to declines can mean missing powerful recoveries.

The impulse to tinker underappreciates how quickly narratives can reverse.

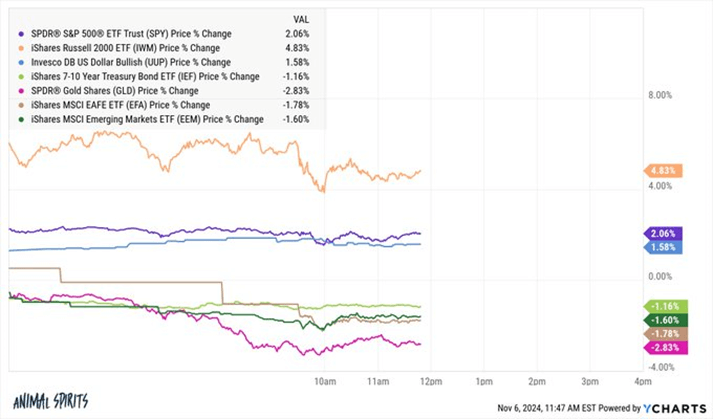

Consider the market’s reaction from Election Day through the day after, as President Trump’s victory became certain.

The initial consensus was that the Trump Presidency would be pro-growth – great for U.S. stocks and the dollar and bad for international stocks, bonds, and gold.

Four months later, the narrative has flipped – and so has the cohort of winners and losers.

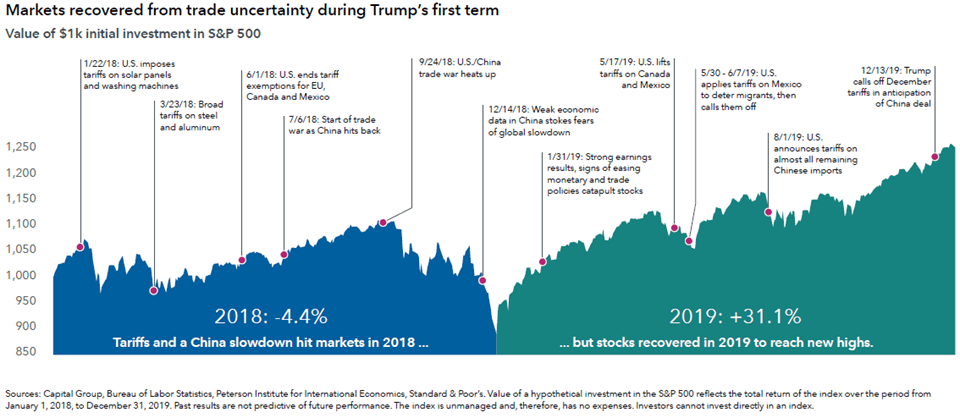

We can look to precedent as well. In 2018, President Trump initiated a trade war with China. Stock market volatility heightened, and the S&P 500 fell after two stellar years.

Then, in 2019, the trade war de-escalated, and the S&P 500 skyrocketed. The takeaway is clear: markets and narratives can pivot quickly and often without warning.

It’s important to be clear about what we do and don’t know. Tariffs are just one part of the equation. Their duration and impact are unpredictable.

Many factors drive markets: earnings, interest rates, consumer demand, geopolitics, and investor psychology, to name a few. Tariffs matter, but they are nowhere near the whole picture.

Ultimately, the market has proven resilient over time. Principles like diversification, patience, and discipline drive investment success, not responding to headlines, no matter how dramatic.

The only prediction we’re comfortable making is this: however the tariff story turns out will be obvious in hindsight. Yes, it could trigger a recession and a nasty bear market. Or, resolution could arrive sooner than expected, and markets might breathe a sigh of relief.

Either way, we are in the storm. It may intensify before it lets up. But this is not the time to abandon long-term plans or throw strategies overboard.

The skies will clear. And when they do, long-term investors will be glad they stayed the course.