We typically separate politics from investing. Most political drama looms larger in perception than in market returns.

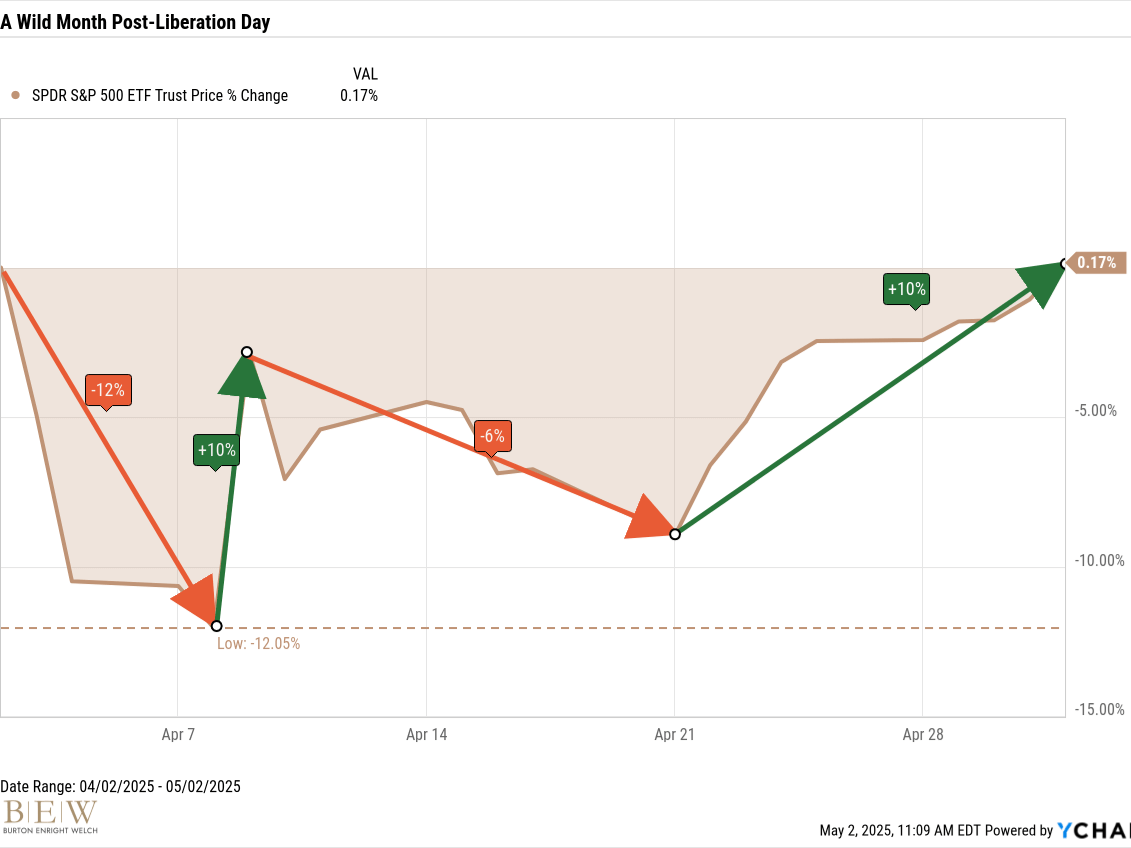

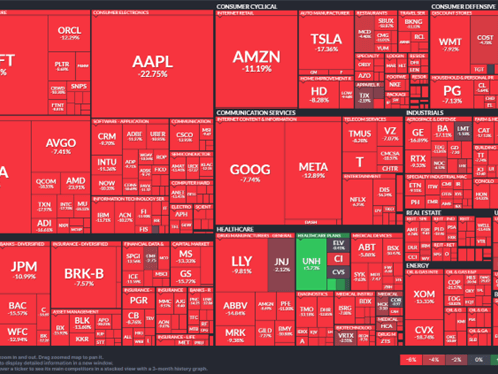

Yet, right now we’re in a political moment. Tariff news and speculation are driving market volatility. The S&P 500 is off nearly 10% from its highs.

After another rough market day, here are some quick thoughts on the short- and long-term.

Short-Term

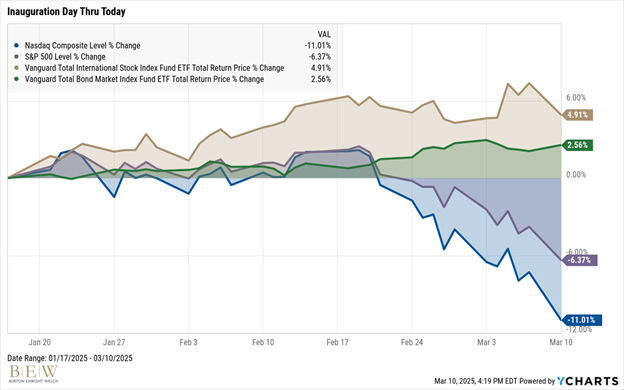

Back in January, we emphasized the importance of diversification.

Not a moment too late, international stocks and bonds have delivered strong returns year-to-date. Despite today’s declines, international stocks have outperformed the S&P 500 by double-digits. Bonds have also performed well, as recession fears pushed yields down and values up.

Obviously, the short-term story can turn on a dime (or a Tweet). For the moment at least, overconcentration risk in the U.S. stock market seems apparent.

Long-Term

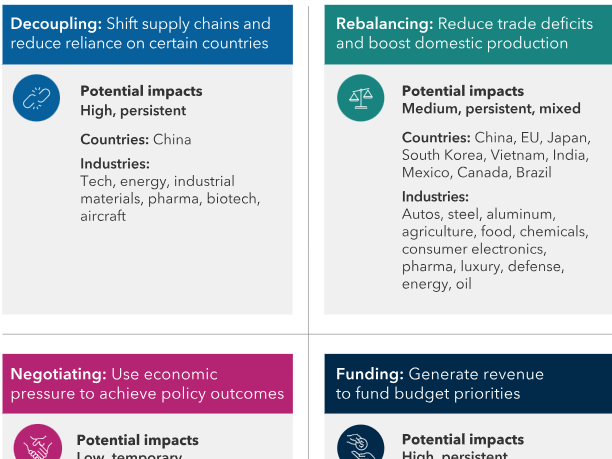

Much of the market’s trouble with tariffs is the uncertainty. Key unknowns include duration, affected industries, and global reactions.

The challenge is to look past the current moment and ask: will tariffs significantly impair long-term returns? Here are three considerations:

- Markets are forward-looking.

- Markets price in both current tariff news and future expectations.

- Tariffs are just one input in the stock market.

- While tariffs may weigh on stock prices, do they outweigh long-term growth drivers like Artificial Intelligence?

- Companies are resilient and adaptable.

- Once companies grasp the impact of tariffs, they won’t stand still.

In his first term, President Trump targeted China with tariffs, sparking trade negotiations that left many tariffs intact. Despite this, both China and the U.S. stock markets posted strong returns.

Tariffs aren’t going away anytime soon. We are paying attention and will likely have more to say in next month’s newsletter. Please reach out to your advisor if you have any questions.