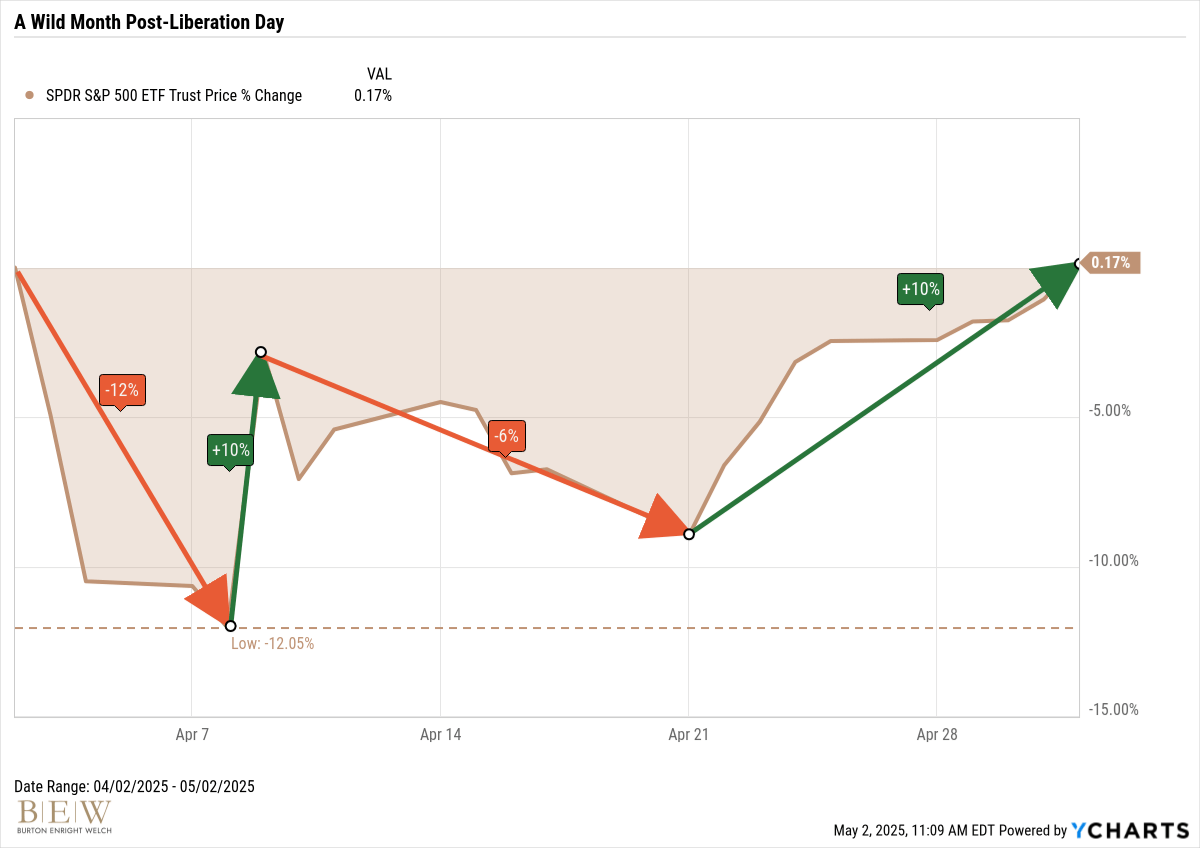

Today marks one month since President Trump’s Liberation Day tariff announcement.

The S&P 500 cratered, reversed, slumped, and rallied over 20 trading days. It felt much longer.

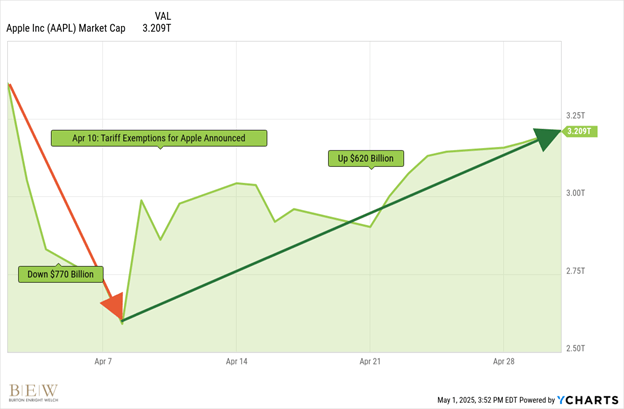

Apple captures the story of the policy whiplash. The threat of tariffs targeting its global supply chain erased $770 billion in value in a single week. But after the Trump administration announced exemptions for Apple’s products, much of that lost value has since been recovered.

It’s confusing. A lot has changed, and yet the stock market is back to where we started.

The dollar is weaker. Consumer sentiment is down. Shipments from China have cratered. Businesses that rely on Chinese-made inputs may struggle or close. Supply shortages may emerge – e.g., for baby strollers, which are nearly entirely imported from China.

These factors and more are causing many economists to speculate about a coming recession.

So, why doesn’t the market seem to reflect this?

While the narrative and vibes have downshifted, no one knows what’s next.

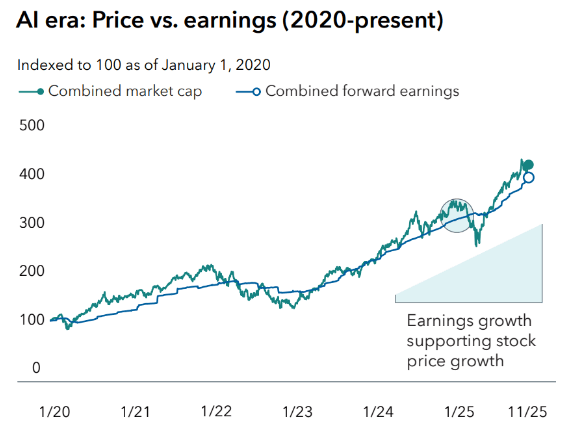

In 2022, with inflation raging and the S&P 500 down 25%, a recession seemed like a fait accompli. But it never transpired.

In 2020, with the economy shut down and supply chains wrecked, a sustained stock market slump seemed unavoidable. The S&P 500 was up 18% in 2020.

Markets often behave in ways that defy logic in the moment. Sometimes, like in early-to-mid April, the market mirrors the mania. Other times, like in recent weeks, it resists it.

For investors, the challenge isn’t predicting what’s next – it’s staying grounded when nothing seems to make sense.

It can be tempting to overhaul portfolios when the world shifts so dramatically. Adjustments may be warranted, but they’re rarely obvious – or well-executed – amid mayhem.

One lesson of the last month – rather than react, staying disciplined amid chaos is often the best response.

Get the BEW Newsletter Direct to Your Inbox

Stay informed with timely perspectives and market insights from the BEW Invest team.